With turmoil comes uncertainty. But here’s what we’re doing about it. Plus, a look into the cashflowing side of parking!

Listen to the audio version of this week’s newsletter!

Things Are About to Get Worse in the Markets

Sorry, that’s the truth. We’ve been seeing the signs for some time.

Here is where we get around them. We don’t do what everyone else has been doing. In a bull market, everyone thinks like this…

Including many of the smartest people in the world. Many are going to get smoked. I don’t say this with joy. I’ve invested money since 2007, so believe me, I know what it feels like to have people call you crying because they just watched their life savings eviscerate. It is not fun. I wish that on no one.

And yet… there are too many pretenders masquerading as investors.

I actually wish a bear market on everyone who takes others’ money. When you raise once and you lose someone’s money, you’ll have a really hard time ever doing it again. Your willingness to grab other people’s dollars will be tempered by your crippling fear of failure. When you invest, you have ONE job, don’t lose. Sadly – we forget this every 10-20 years as the bull market runs.

BUT – there is a golden lining. Every time a market turns, there is an opportunity. So if you’ve been one of those thinking:

- Ugh I missed x

- Should I just throw some money at x

- I probably missed my chance with x

- I’m PANICKING because all I see is RED

Here’s the truth investors know, it may soon be time. You have to wait for the blood. You have to wait for it to be REALLY uncool to invest again. You have to wait until companies beg you for money, not you beg to invest in them. It seems simple, and yet so few do it.

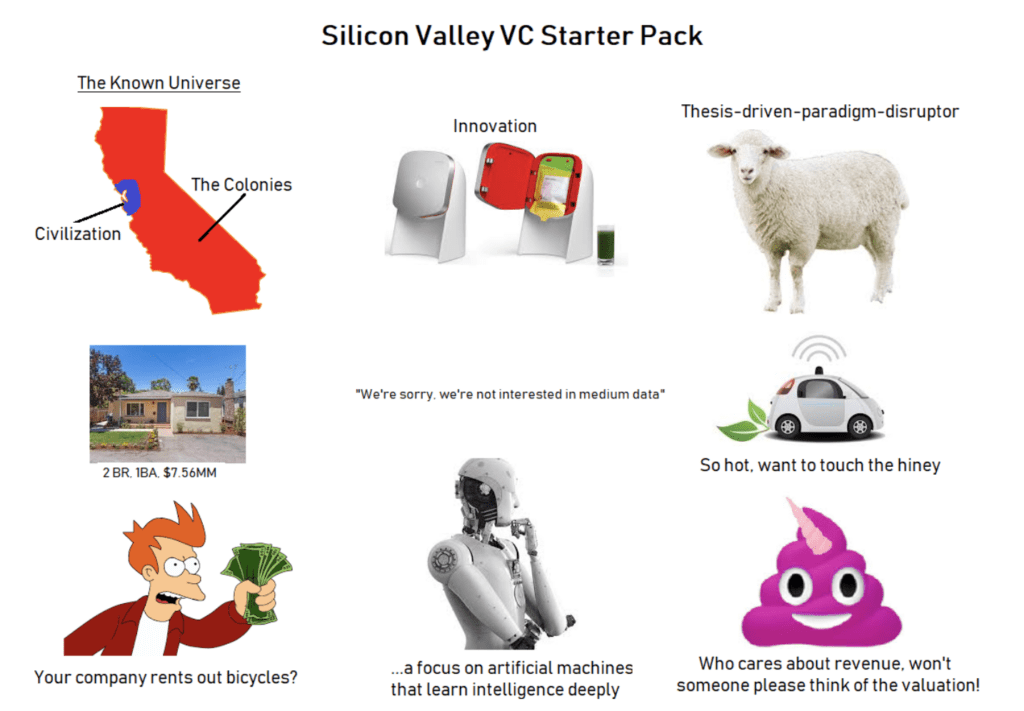

There is a reason I raised zero money over the last 2 years while rolling funds were popping up like pimples on a teenager. There is a reason I’ve been buying recession-resistant boring businesses. There is a reason I just NOW launched an early-stage boring business infrastructure fund. Why? Because things are getting bloody, and they’re going to accelerate. We didn’t invest in anything at all-time highs and then have to work our way out of that hole. Huge caveat: I’ve lost money before, I’ve made massive mistakes, and most of Silicon Valley is 10x smarter than me. No high horse here.

The difference that will be a win right now is not investing in dreams and hopes but investing in realities.

Here’s to you grabbing reality.

I met a guy who buys individual parking lots in condo buildings when the tenants don’t want to buy them.

They cost $30k a year, and he cashflows $5-10k a year off of one spot. Then I had a call with my friend Michael Girdley who said he’d often rather own parking lots in the right places than Saas companies. Hm… This got me intrigued, so we’ll break it down for you. Because the way around what is happening in the market is simple actually:

The BRRT Method

- Buy – Buy businesses that cashflow

- Resist – In recession-resistant sectors

- Raise – With the ability to raise their prices

- Tech – And add technology to their offerings

That is my recipe.

Let’s apply it today to a sector I’m considering as we speak. Big ole chunks of asphalt.

How to play parking lots for $75K+/year cashflow.

Let’s break down a deal. You do due diligence on a lot. Then you go to professional operators and have them sign a NNN lease (meaning they pay for everything and pay you out) and then cashflow while they operate. This is the ideal situation although not always the easiest.

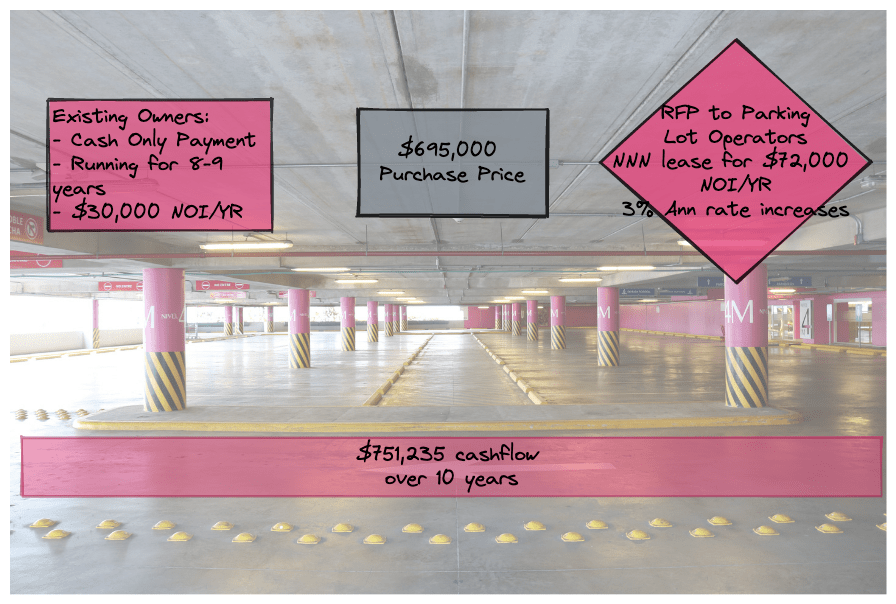

Location: Wilmington North Carolina – in the historic district

- Purchase price: $695,000

- 26 lots in total

- Prime location walking distance to all of downtown

- 80 feet of air rights meaning you can redevelop to highrise

Why it was interesting?

There was a lot of upside in this opportunity. This lot was owned by a local doctor whose son ran it for 8-9 years with only cash payments and no credit cards. No marketing, poor signage and no technology was used. Here’s how it looked:

- Current NOI (how much $ they made): $30,000 a year

- NNN lease terms: (how much an operator will pay them): $72,000 with 3% annual rate increase

So this property went from:

- $30,000 a year to $72,000 a year income

Take that over the course of 10 years + 3% increases and we’re talking about cashflowing $751,235 on a property that costs $695,000.

Parking… the ‘covered land’ play.

Is this just a small one-off deal? I don’t think so, parking is a big ole business.

Parking lots, done right, provide immediate cash flow while providing future profit LATER when sold. What’s so special about parking? Here’s what makes parking one of the 130+ businesses I like to buy

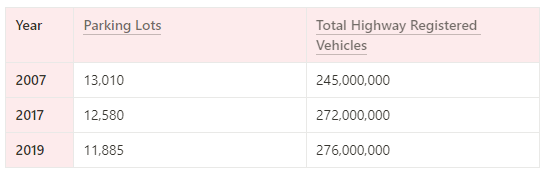

#1 Declining inventories, increased demand.*

Total parking lot numbers are declining, while total registered vehicles are increasing. Think about it; you’re a local politician and must decide between boring parking garages or sexy high rises (apartment or office). Based on tax revenues, greatest use, and visual appeal, you’re choosing the high-rise every time. So parking is a necessary evil and an asset usually considered last by those building our cities. You can see for yourself the number mismatch below, with registered vehicles increasing while parking lots decrease.

The elephant in the room for parking lot investing is future demand. COVID-19, and the government’s reaction to it, did an absolute number on parking lot usage. The National Parking Association estimates that events saw the greatest loss in revenues with a 75% drop, Airport parking was next with a 50% drop, Office parking saw a 40% loss, and Central Business Districts (CBDs) saw a 40% drop. I don’t think anyone paying attention the last 2 years will be surprised by those numbers. People were working from home, staying home, and generally avoiding one another. It’s always important to conduct extensive due diligence; this asset class deserves an additional second look because of the uncertain future demand.

#2 Technology = Variable pricing structure

Airlines use sophisticated, real-time calculations, to guess how much you are willing to pay, minute by minute, adjusting their prices to maximize profit. Just like airline tickets, parking is worth more at different times and demand levels and technology is making dynamic pricing for parking lots a reality. You can use software like Smarking to do just that.

#3 No need to call a plumber

I can’t think of something more low maintenance than a parking lot. I get all hot and bothered thinking about tow trucks doing the circling to stop slackers, security cameras doing the oversight, and a minimal cleanup team weekly. With lines on the pavement, concrete bumpers, a gate or concrete enclosure, and the technology to run the lot, you’re set.

#4 Revenue stability, recession resilience.

We’re experts in cash flow here, not a particular asset class. So, we reached out to a friend who’s been in the business for decades and asked him why parking is a great investment. His name is John Roy, you can find his interviews all over multiple podcasts on real estate investing, and he’s the founder of JNL parking. Here’s what he told us:

- Revenue stability and passive cashflow-don’t run a lot yourself: a triple net (NNN) lease with a reputable 3rd party operator is the best way to guarantee parking revenue. Before buying a lot, have professional operators bid on what they would pay you to run the lot. As COVID changed the landscape, John recommends that leasing with 3rd party operators is less common post-COVID and most operators will look to take a % of your monthly sales (20% of monthly sales, for example) or a flat management fee for running your lot. Kind of like typical property management. Here’s an example of such a service.

- Parking is recession resilient: Ignoring COVID-19’s impact, parking demand is historically relatively inelastic, making parking a recession resilient asset. Generally, gas prices, inflation rates, who’s in the White House, pick your usual suspect, parking demand remains unchanged.

#5 Fragmented asset class.

While there are some large scale operators (REEF, SP+), parking lot ownership is not localized or hyper-competitive. You won’t always have to compete against the ‘bigs’ as you’re looking to purchase parking lots.

3 Steps to finding and buying your own parking lot.

For you ‘skip ahead’ readers who might have missed it above, we’ll say it again here. Parking lot investing was significantly impacted by COVID-19; estimating parking demand (particularly business lots) is still very much in doubt. That said, the right lot, with the right demand, is intriguing.

- Find parking lots for sale. Find assets in Tier 2 markets as Tier I markets will be prohibitively expensive. Finding Tier 2 markets could be an article in itself, but the best way to identify potential Tier 2 markets is to look at demographic-based studies.

- Business brokers.

- Search using listing aggregator sites such as Crexi, LoopNet, and BizBuySell.

- Reach out to international/national/local parking lot associations (IPMI, NPA, Parking Today magazine has local listings) and see if they know of interested sellers. Many of these organizations also have events, websites, and contact information for someone willing to hustle and find motivated sellers. Hell, we even found a classified listing once on Bigger Pockets!

- Cold call owners in the area you are looking to purchase.

- Something like “Hi, my name’s Jim (if that’s your name) and I’d like to make you an offer to buy your parking lot. I’m not a broker and don’t need tons of information to make you a credible offer. I’m not looking to lowball you or waste your time as we do this with consistency. Would you be open to a sale at the right price?”

- Evaluate lot potential.

- Lots near long-term sustainable parking demand such as multifamily properties without existing parking, nearby sports venues, entertainment areas, and perennial local hotspots. LEAST desirable in the current COVID climate are office buildings, and high-rise office complexes. SO-SO desirable is airport parking.

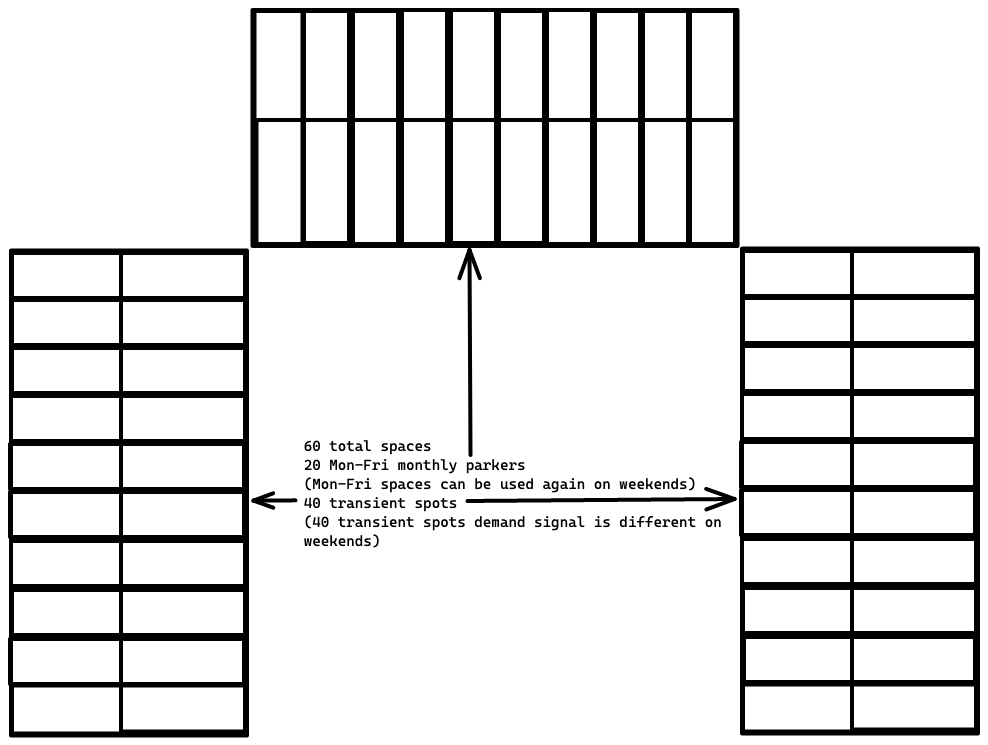

- Lots with high turnover. Think of parking spaces as assets that can serve multiple demands in a 24-hour period or a seven-day week. It might be good parking for a local business district and on the weekend a hotspot for nightlife. The more demand streams that your individual lot can satisfy, the better it is as an investment.

- Lots that fail the fax machine test. You’re looking for parking garages that are still using drop boxes for payment, that aren’t easy to find in a quick google search, taking cash or requiring payments with outdated technology systems. Today, your main goal is to leverage technology that helps you audit your operator’s sales reporting.

- Lots with air rights included as part of the purchase. If you’re looking to sell the space later for a taller building, and you should be, then understanding air rights and what you are purchasing is an important component.

- Price the Lot. After you’ve found lots for sale and then evaluated their potential, it’s time to price it.

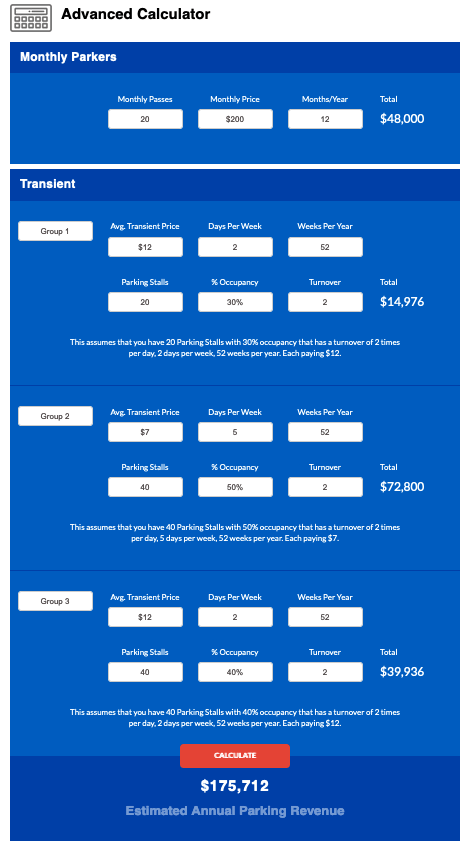

- Map out your lot. Make copies of your map for each different demand stream. We used Excalidraw here because it’s free, but again you can draw it on a napkin. The point is having a visual representation you can consider across multiple time frames.

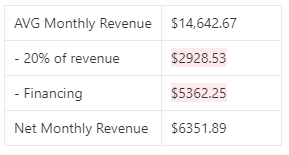

- Use the calculator to the left from Parkingboxx or this one from ParkHub to price your potential revenues. This is WHY you needed to map your lot and make copies of it for different demand streams (day/night/monthly/transient/etc) to ensure you are capturing all the different revenue streams your lot may have. The example above has 60 total slots, 20 of which have monthly pass holders from Monday through Friday). Those 20 monthly slots can be re-used on the weekends. The other 40 slots are transient, but the demand streams for those 40 are different from weekdays to weekends. You can see now why mapping your parking and seeing the different potential demand streams is so important.

- Submit an RFP to your parking operator of choice for bids to run the lot you intend to purchase. Respondents to the bid will either:

- quote you what they’d be willing to pay for a triple net lease for that space. John tells us this used to be pretty common, but post COVID you’ll need to negotiate

- quote you a % of the monthly sales

- quote you their flat management fee charge

Subtract your operator costs (or if you’re lucky, see what their triple net lease revenue would be) from your projected revenue as well as any financing you require.

For our purposes, let’s assume:

- the number from our YouTube friend above-purchase price of $695,000

- 35% of the purchase price down ($243,250), financing $451,750 over 7 years

- 20% of monthly sales to operate the lot

Not too shabby.

Park your assets,

Codie

Parking Lot Due Diligence in Action.

From Tech Founder to Middle-of-Nowhere Airbnb Host

Our friend Sam Parr, whom I’m sure you know of the Hustle who sold to Hubspot, traded tech startups for Airbnbs. Not just any Airbnb… a ranch. Here’s how he plans to make $20k in the first few weeks of listing!