Sexy Celebs, Boring Businesses = The How to game

Welcome to the 1600+ new Contrarians who joined last week.

Celebrities -> Becoming Sweaty Biz Tycoons

I’ll be honest. I typically like celebrities to stay in their lanes.

I don’t watch shows to hear their political opinions, how they think everyone should be Vegan or whomst they voted for (even if they were my candidate). *Can you hit me up in the comments… does anyone really vote one way or other because a celeb told you to? *

Such an inappropriate thing to say buttttt, athletes are paid to take varying-sized balls and put them in things. Politicians – oops I meant actors – are paid to play pretend on tv, and models are paid to ya know, look good in things.

At the threat of being horrifically condescending (too late), I like to take my advice generally from people who have the experience doing the thing they are giving advice on. Celebs can be geniuses, but unless they’ve walked the walk they’re not my guru.

Free speech is critical but doesn’t mean you have the right to be heard, just the right to speak. So I’ll keep paying to watch them perform, not pontificate.

How’s that for a triggering start? But – where am I wrong? Really?

Here’s where I eat some mud… some of these celebs have taken their audience and turned it into solid gold

I used to LOVE ragging on the Kardashian’s. #troll-life

I mean this metaphorically… easyyyyyyyyy.

But you can’t argue with their business sense. They have absolutely dominated turning an audience into profits.

What I can certainly say is, I don’t vibe with many things they stand for such as, do we women really need to wear that much makeup? Must we slosh ourselves into constricting undergarments a la Skims? Would I strive for all those divorces and sex tapes and plastic surgery? Meh, not really. But hell, I’m divorced and far from perfect. Glass + house.

ALL THAT SAID, SHAQ YOU SLY DEVIL YOU…

If you’re going to take financial advice from an athlete, make sure that athlete’s Shaq.

Did you know 60% of the pro athletes end up broke within 5 years of retiring? They’re not joking when they say professional athletes die two deaths in their lifetime.

Meanwhile, basketball’s friendliest giant is making more money as a retiree than he did during his legendary 19-year NBA career.

Read that again; Shaq’s making more now than back then? Was it all Kazam is the question I think we all really want to know?

7’1’’ or not, that’s the upwards wealth trajectory I’m after.

While Shaq’s success in basketball may remain a jumbled mystery of genetics, insane spatial awareness and hard work, the steps he took to financial success we can follow.

Teach Me To Dunk Dollars: So how does he do it?

Shaq himself says the best financial advice he ever got was from “a guy at a bar.” Who turns out to be Lester Knispel, one of Hollywood’s top business managers, but yeah, still technically a guy I guess?

Save more than you spend.

Riveting Lester. I think we’ll just stop there…

BUT… Saving only Gets You So Far

And that’s a secret Shaq is also in on. While he’s been tight-lipped about his earnings we can do a lil’ estimation:

- His highest-paid year in the NBA was a $27.5 million annual contract playing for the Miami Heat

- Today, he makes about $20 million in endorsements alone

- The rest of it comes from a whole portfolio of small businesses. This is where it gets interesting.

REAL cash flow means you’re making money while you sleep.

Sure, you could sell your soul to the startup hustle but if your goal is financial independence that’s not necessary. What you do have to do is put some of that saved money to work.

Why?

Because whether ya recognize it or not, the goal of financial independence is leverage. Leverage so you can make more time to spend with your family, pursue your hobbies, and keep the flywheel going.

“I’m tired of hearing about money, money, money, money, money. I just want to play the game, drink Pepsi, wear Reebok.”

– Shaquille O’Neal

So, leverage is the ULTIMATE goal, and to get there you need some momentum to get your financial flywheel up and running.

This is exactly the kinda financial flywheel energy we’re going for.

Here’s the Breakdown

Shaq’s owned (and sold) 155 Five Guys restaurants (comes to 10% of the company’s ENTIRE franchise portfolio) and currently owns:

- 17 Auntie Anne’s

- 150 car washes

- 40 – 24hr fitness centers

- 9 Papa John’s

- One-offs like a Krispy Kreme and a CityPlex12

- “Shaq Shoes”, his affordable Walmart sneakers (that sold over 120 million pairs)

Now Shaq started buying up these small businesses while he was still playing in the NBA, WITH a multi-million dollar salary. Why would he ever want or need a side hustle?

It’s because he was onto something that we’re all discouraged from doing when it comes to our income: diversifying.

Most of our 9-5’s are just jobs — jobs that pay the rent/mortgage/ food/utilities, but also jobs that we can be fired from or disappear in the blink of an eye. It’s a lesson that most professional athletes learn the hard way when they’re forced to retire. That they have no backup plan and while they earned well, they spent well.

Once those earnings dry up? Shhhhh… just go put balls in hoops.

So car washes and Aunt Anne’s? Far from sexy, but do they bring in the dollars? You bet. Shaq’s currently worth $400 million and counting and brings home almost double his highest annual salary while he was playing in the NBA.

The Economics of Boring

There’s a difference between fame and being rich. Unfortunately, today’s entrepreneurs confuse the two. It’s basic economics at the end of the day. Sexy businesses? They’re in demand sure, but careers are asset classes in themselves so when everybody wants a certain kind, guess what?

They get inflated.

And your returns drop.

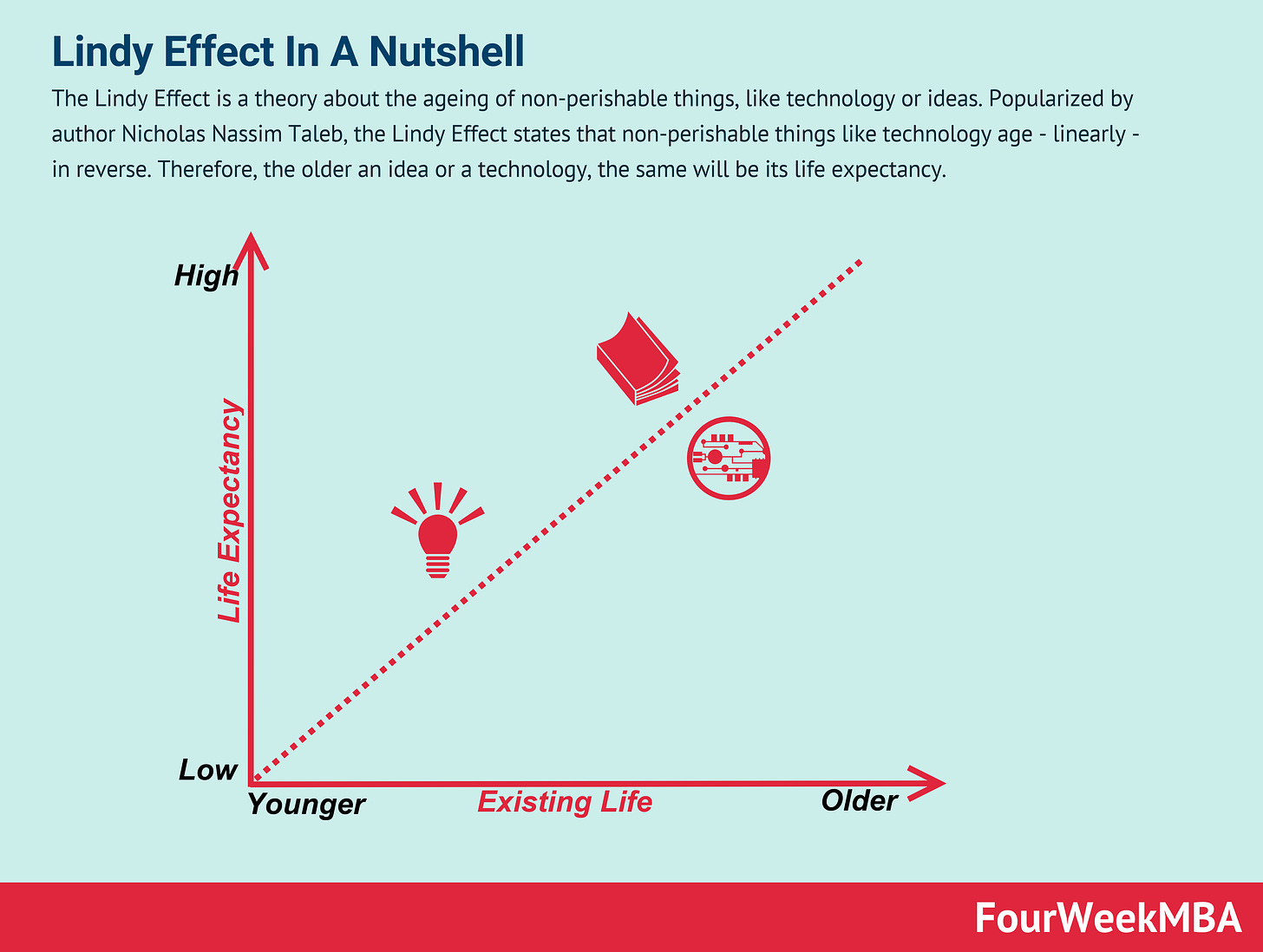

The Lindy Effect. Basically, it states that the longer an idea has been around, the more it’s likely to stick around and stay in style. I find it interesting that these principles seem to translate to businesses too.

Some of you may be familiar with Nassim Taleb, author of Antifragile: Things That Gain from Disorder. He puts another twist into this whole discussion, arguing that the failure rate of the new is actually much higher than that of the old, even though we may think that old things are going out of fashion or are less valuable than new ideas, businesses, whatever.

Every day that something exists may imply an overall longer life expectancy.

Who Else is on That Boring Business Trend?

Now Shaq’s not alone in his “boring” ventures.

#1 Warren Buffet: Pinball Machines.As the story goes, 17-year-old Warren and his friend installed a $25 pinball machine in a barbershop, a year later they sold their business which had spread across Washington. D.C for over $1,000. Which was huge money back in the 1700’s when he did it (wink). According to Warren, it’s still the best business he was ever in.

*By the way did anyone else here know that Buffett has been part of a throuple for decades???

#2 Magic Johnson: This guy has a portfolio of businesses that range from food services all the way to job placement and coffee. And they can be thanked for most of his $600M net worth today. Some of his investments include:

- 125 Starbucks stores (Johnson was the first “outside owner” of a location. He also put locations in urban areas and changed the menu to cater to his market.)

- Movie theatres and malls

- 31 Burger Kings

- EquiTrust Insurance

- 24 Hour Fitness

- 4.5% stake in the Lakers (turned $10M into $50M)

- LAFC Major League Soccer, LA Dodgers and L.A. Sparks (WNBA)

- JV of $8B to rebuild LaGuardia Airport (about damn time)

- Partnered with Canyon Capital, financed 30 real estate developments in 13 different states.

- Mitu: a Latin-fueled media brand

- Uncharted Power: a renewable energy company

- Walker and Company: a company making beauty products and services for people of color

- The Marvel Experience & Walt Disney Imagineering

Just a little taste, but you can see more on his Magic Johnson Enterprises $1 billion portfolio.

The Path to Billions is Boring

Billions don’t have to be made in the complex.

Boring wealth is all around us.

If you look at some of the wealthiest individuals out there their niches are pretty dull, we’ve got the Waltons of Walmart (retail), Koch Industries (manufacturing and distribution), and countless mining, oil, and real estate bros.

The person who runs your neighborhood carwash? A lot richer than most people.

Their companies don’t make fantastical headlines and aren’t always on any Forbes list, probably by choice.

BUT

Let me ask you this, when this sugar rush of a stimulus turned money printing carousel ride ends, what will you give up first? Your NFT purchasing habits, or the fact that you need clean clothes, a clean car, and a cup of coffee?

Un-sexy and boring they may be, but recession-resistant they probably are. Good on you Shaq, you’re dunking way more than basketballs these days.

We’re going to do a breakdown of either carwash businesses, Starbucks or franchises, which one you want? Hit us in those comments.

Question everyone and stack unsexy,

Codie, Rikki and your Contrarian Team