The average millionaire has 7 streams of income. The average American? They have one. Yikes. So, this week we’re talking about how I’d get to 7 figures, in 7 income streams, in 1 year.

Doesn’t that just roll off the tongue? The part I think is perhaps most intriguing is that if you would have asked 25-year-old Codie, I never would have thought about using this process. I was so focused on increasing earnings and so unthoughtful about increasing assets. It’s incredible how much you can grow and change in 10 years. Never forget that.

In <10 Mins, We’re Going to Cover:

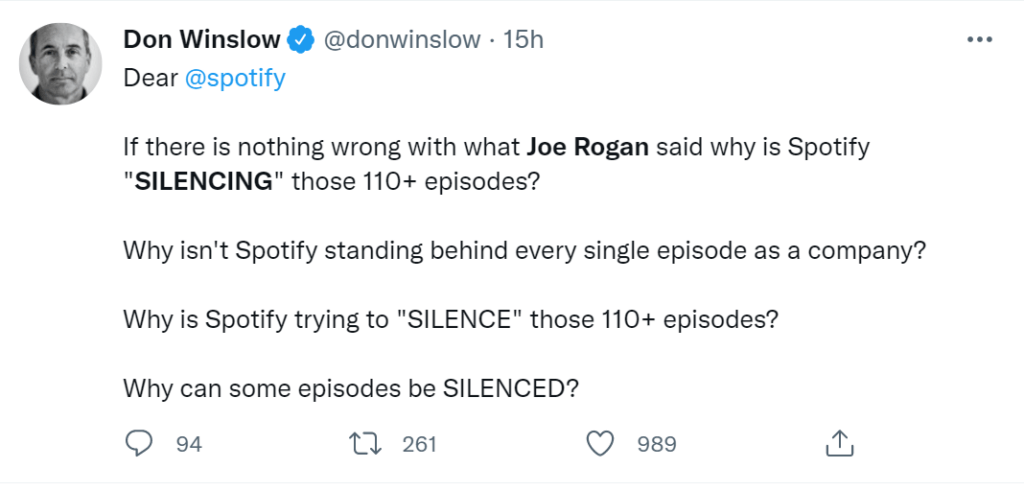

- The problem of silencing, and the power of voice

- Why one income stream is a death sentence today

- 7 steps to 7 income streams in 12 months

RANT: Future Silencing, Dangerous & Imminent

But before we get to the income streams let me tell you WHY this is my largest focus today and an argument for you to ponder the same path. It revolves around two words, free speech. And y’all know how much I love free anything.. except free gluten, I’m gluten-free. So keep the gluten and give me a voice instead.

This week was odd. I was on vacation, tropical paradise-ing, during which I slowed while the world continued to turn. Vacations are a glorious reminder of the fact the world does NOT, in fact, need any one of us. We are as grains of sand to an ever-flowing beach. Here, relatively unremarkable, replaceable, and forgettable. I’m sure fun to have at a dinner party, eh?

Morbid thoughts on our fleeting lifespans aside, this week I had that scarily beautiful thing on my hands… a bit of time.

With it, I perused what the world deemed the most important news according to any of my feeds: Joe Rogan, Spotify, and Neil Young. Hmm. It sort of reads like a joke: “A former reality star turned comedian and a rock star past his prime walk into a bar…”

Now for those of you who know me, you know I stand by this saying as the ENTIRE reason I began Contrarian Thinking:

I disapprove of what you say, but I will defend to the death your right to say it.

As a former journalist turned investor, I know there is only one thing more powerful than money… words. Most look to control the price of things while the pros know it is best to control the terms. That is to say, control the language, control everything.

Thus I find what is happening to Joe Rogan to be troubling, to say the least. I have no loyalty to the man, I surely do not agree with him on many fronts, and yet, when we start virtue-signaling what can or cannot be said by comedians of all people then who is safe? Who or what is next?

Let’s call canceling what it really is… silencing. Joe does not need more money, sponsors, or fame. But it’s not really about Joe, there is something more dangerous than what happens to him. Much more dangerous. It is what happens to the next “Joanne” who is now in her 20’s watching this show from the sidelines.

It is what I call future silencing.

If the most popular podcaster in the world can be brought to his knees for questioning the narrative, what does that tell the next generation? What does that tell the up-and-comers? What does it tell those poor youngsters full of half-baked ideas their future selves will think are ridiculous and even horribly wrong or embarrassing? It says, do NOT question anything. Do not let your ideas play in the arena to see if they can fight to the death. Instead, STAY QUIET, stay agreeable with the norm, bring nothing new. Because you may be wrong, you may error, times may change, context may be excluded and that would be dangerous. Your evolved adult self will be demonized for your idiotic younger self. Your airing of views that not all agree with means you will not be able to air ANY ideas.

What happens if we are not growing and debating and innovating with ideas? We begin to atrophy or die. I don’t really care about Joe per se, I care about all the ideas yet to come from those who are observing this takedown. Without risk-takers, the world as we know it wouldn’t exist. Without strong argued, loosely held beliefs we’d never grow.

So when that tingle of affront and anger hits, when you feel you have to cancel or silence another, why don’t you instead think to create a counter-argument? Battle them with your own ideas. If your argument is better it will win. If it is not better it doesn’t deserve to win. But do not ask for another’s hands to be tied behind their back so yours can succeed in punching them in the face.

BE BETTER don’t expect someone else to BE QUIETER.

7 Income Streams: A How-to

The biggest path to freedom as we can tell from Joe is having no one singular master. Spotify is like a single income stream. Single income streams can be ripped out from under you. Here’s the path I would take to ensure that no matter your opinion, your job performance, your health status you can keep on earning.

Part 1 – Start w/ a “platform” acquisition.

The wrong way to get 7 income streams? Go off and open 7 new businesses at once. The likelihood of failure is incredibly high.

Instead, what would I do? I’d buy a platform business you can add on to (you use loans and SBA to put down minimal cash read end to see more on that).

Let’s say it’s a laundromat to keep the example easy. Here’s the how-to for valuing and buying them, but the quick suggestion is to save that for the end before you go re-reading.

(Do you already own a laundromat or are you looking to acquire one? Take your business to millions in revenue! Click here to learn more)

Let’s imagine your deal goes something like this…

1st Laundromat Deal:

- $67,000 profit a year

- 0-15% down for the purchase price of $100k

- Use $100k in seller financing (using future sales to pay off owner)

- Finance down payment w/ equipment loans on machines.

Now you have a laundromat under your belt and your 1st additional income stream.

INCOME: $67,000 profit

INCOME STREAM COUNT: 1

Part 2 – Add on acquisition.

Time to add your second stream. I’d get the first 30 days of operations under my belt and then I’d probably add in a series of vending machines at my location first. Think snack vending, soap vending, toy vending for kids. Followed by perhaps a few other vending machines in your local shopping center since you’ll be servicing it anyway for your laundromat. Perhaps you do a 1-mile radius so your laundromat operator can operate both of them.

Now you have $67,000 profit from a laundromat then $50k profit from vending machines in multiple locations let’s say.

INCOME: $117,000

INCOME STREAM COUNT: 2

Part 3 – Vertical acquisiton

Now your laundromat is fully operational. You are maybe 90 days out and as you grow the business you get to know your competitors and other operators. In your conversation you find Bob, he’s run his for 20 years and Austin has just gotten too busy. He wants to move out to the country so you ask him if he’d like to sell you his laundromat. He says, “Well, reckon I might.” You use seller financing to pay from his future profits for you to buy his business. You send Bob a monthly check and plan to pay him off completely in 3 years while he doesn’t have to work but still gets paid a check each month.

This was a bigger more established laundromat and wash and fold service, making $300,000 in profit because you know the game a bit better now.

INCOME: $417,000

INCOME STREAM COUNT: 3

Part 4 – Asset acquisition: Machines

Now after Bob teaches you the ins and outs of his laundromat you realize man, your laundromat could have more capacity for more machines and be much more profitable. So you shop around to see if anyone wants to sell you some used machines. After all, China has waylaid a lot of the supply chain. A broker you’ve gotten to know says another store is going under, so you buy out their equipment for pennies on the dollar.

Now your increased capacity = $50k per year.

INCOME: $467,000

INCOME STREAM COUNT: 4

Part 5 – Satellite acquisition: Delivery

Now laundromats are great and passive, but you’re aggressive and want to grow. You want more margin and higher-end customers. So you purchase a van delivery fleet from another company, add a wash and fold service and now you have another $250k in income from this service add-on.

INCOME: $717,000

INCOME STREAM COUNT: 5

Part 6: Horizontal acquisition: Products

One of my favorite ways to diversify my income streams is what I call a P&L review. I look at all the things I spend money on and figure out how can I turn my costs into profits. So you start to think about one of the biggest costs in the laundry. The soap. Why not buy a mixer of commercial-grade soap, brand it, bottle it, cut costs 30-50%, then go sell to your competitors as well under a different name? So you buy that business and do the same thing, or you partner on it and take a revenue share, or an affiliate fee. That’s another $200k per year.

INCOME: $917,000

INCOME STREAM COUNT: 6

Part 7: Hard asset acquisition: Real Estate

So you have a ‘lil budding business empire doing $917k profit, and hopefully more if you’re growing all the underlying divisions and companies. Your biggest expense besides labor is probably your leases and real estate.

Why not buy your strip mall and be a landlord to your businesses in tandem with all the write-offs, depreciation, and tax benefits that come with real estate?

That deal equals another $100k in profit.

INCOME: $1,017,000

INCOME STREAM COUNT: 7

THE MORAL OF THIS HERE STORY

You could spend months (or even years) trying to start a business from scratch, and you still might end up at zero after all that effort. The failure rate of startups is incredibly high. You could attempt to do this all with passive investing in the stock markets. The returns would take some time or A LOT of money and luck.

Maybe another path? Buy an EXISTING business.

It’s already set up – customers, employees, and systems.

The voices in your head

I can already see the comments saying “Yeah, but that’s SO expensive! You’ll need to invest millions!” Not always true. Many businesses can be bought with little money down (or even zero).

Here’s how: Seller financing.

It allows you to put down part of the purchase, and then pay the seller over time with a % of revenue. There are thousands of businesses for sale in the US right now. Over 10,000 Baby Boomers retire EVERY SINGLE DAY – many own businesses! Now you’ve got your 7 streams of income.

What’s next?

You have more cash flow that can help you buy even more businesses, or scale the ones you have. We use laundromats as an easy example but there are much better options w/ higher ROI.

The lesson? Free men create more, take more risks, build more, grow more, and give more. Make yourself a free human and see what happens.

Question Everything,

Codie

Contrarian Favorite Things:

Some of our favorite tools we use to run this here ship, you asked we linked:

Convertkit – How do you achieve a 45% open rate and a one-stop shop for all your creator email needs? The same way you’re getting this here newsletter!

Hypefury – How do you grow to 120k followers on Twitter without losing your mind? With this tool.

Thinkific – You have knowledge you want to share with the world. How can you launch a course and make $87k in one launch? On this platform!

*PS: Is this segment useful? Do you have more things you want to see from us?