The Rich Don’t Have Different Rules, They Just Know Them Better

Welcome to the 326+ of you who joined the Contrarian Crew this past week. Let us know…what’s something YOU’D like to know about investing and passive cashflow? Feel free to reply directly to this email with the answer.

And if you like this post about a $5bil IRA, share it with your friends so they can get rich too and don’t have to keep saying they’ll Venmo you but never do…

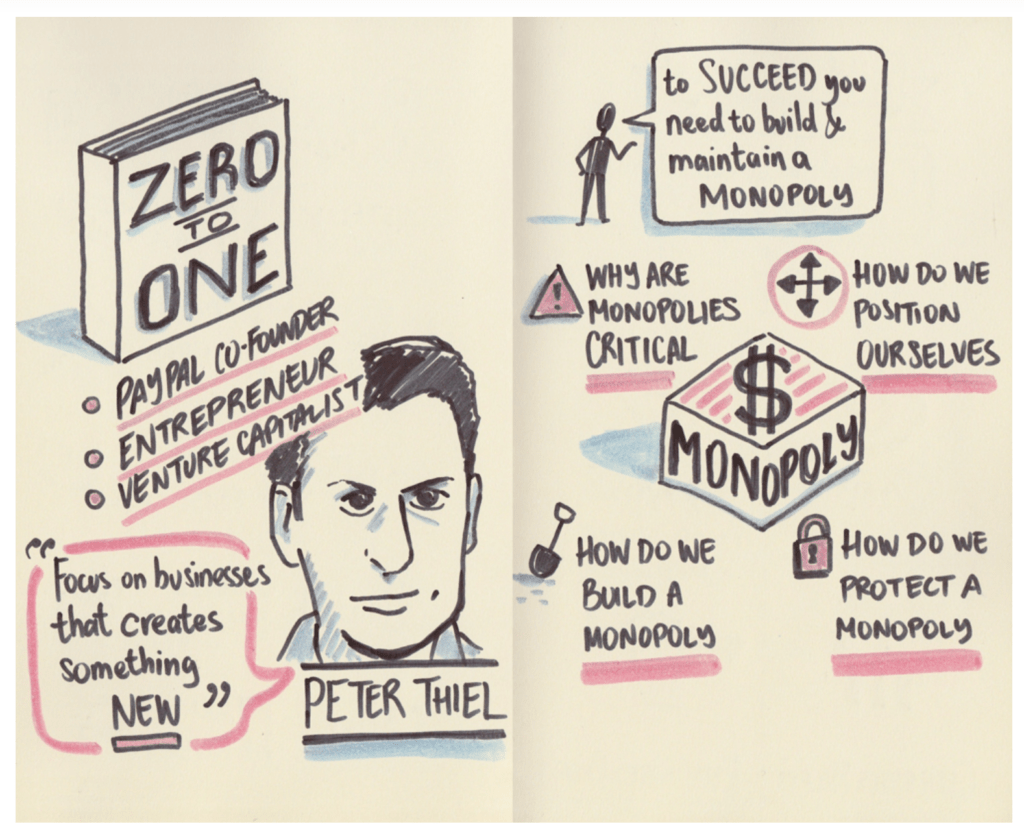

Are you tracking what’s going on with Peter Thiel?

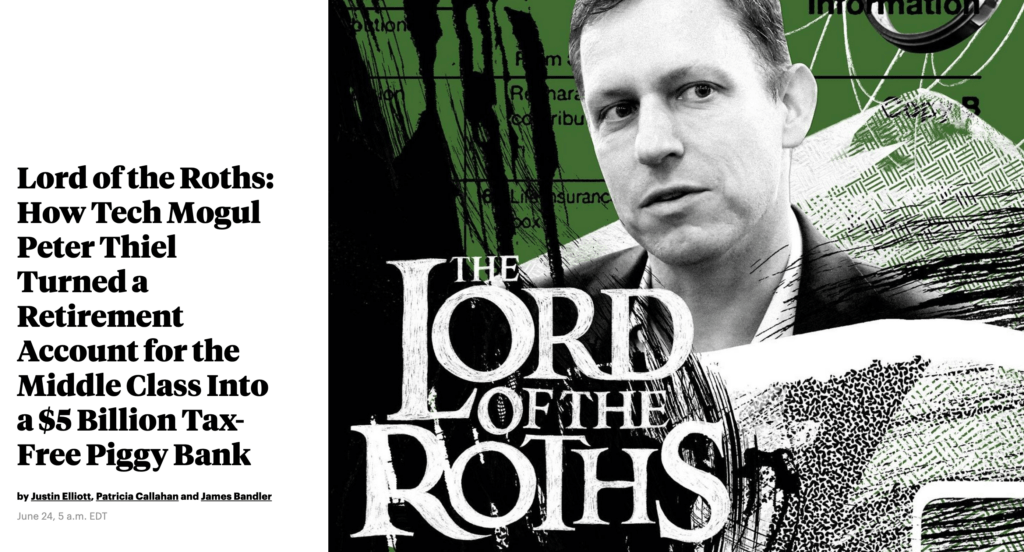

If not, congrats on avoiding the attention trap that is news these days. An incendiary article came out last week:

Let me summarize the novella:

- Peter Thiel knows how to use a Roth IRA (a tax deferred government vehicle for savings)

- He used it to accumulate $5 Billion in wealth

- In Sum…He’s disgustingly rich so he must be a criminal

- *Sidenote he’s apparently really into Tolkien, Hobbits and Lord of the Rings

Now I’m not a tax accountant (neither is the crew who wrote it), so who knows, in the billions Thiel has accumulated maybe he’s done wrong. BUT – as mentioned in said article, he’s been audited before and was never fined.

The real point in my mind is, instead of saying shame on Peter, instead ask, how can WE ALL get smarter on how to create and store wealth? After all, he was proactive enough when he founded one of the world’s most impactful companies (PayPal), to put his shares in a tax-deferred vehicle that has turned into those billions.

But ya know, getting people angry sells ads so the article included lines like:

Roth IRAs were intended to help average working Americans save, but IRS records show Thiel and other ultra-wealthy investors have used them to amass vast untaxed fortunes.”

OR

What this secret information reveals is that while most Americans are dutifully paying taxes — chipping in their part to fund the military, highways and safety-net programs — the country’s richest citizens are finding ways to sidestep the tax system.

OR

One senator said, “Tax incentives for retirement savings,” he added at the time, “are designed to help people build a nest egg, not a golden egg.”

Here are the questions we should be asking:

- Who gets to define what makes a nest vs a golden egg?

- Does the government get to tell me how much money I should want for MY retirement?

- What does sidestep the tax system mean? You literally give us citizens rules on where we can get write-offs and we follow them legally and then it’s wrong?

I’ve still never met anyone who asks how they can overpay on their taxes. Many just start more businesses or donate to charity or any endeavor that is INFINITELY better than giving the government your money.

Ask yourself this question:

If I could magically:

- Have all the millionaires & billionaires pay more in tax

- OR

- Have all of us earn more and keep more wealth

Which would be a better goal to focus on?

Or who would you give your money to to grow and allocate it?

- Jeff Bezos & Elon Musk

OR

- AOC & Dan Crenshaw

Pretty solid answer IMHO. If you’re a politician it’s the former. If you’re a human with a brain, it’s the latter. I don’t get off on making people earn less, I get off on helping more people make more.

Agenda for today’s article:

- How Peter deferred $5 Billion from getting taxes

- How you can too

- How to think like the wealthy to begin with

Let’s start off incendiary, shall we?

I agree with my friend Rohun.

Unfortunately, we all went to school, but most of us (me included) didn’t learn the important things. And apparently neither did my accountant. If you’re reading this you’re fired.

We didn’t learn:

- The true path to health, wealth, happiness and impact.

But I can surely name all the state’s capitals and tell you when Columbus sailed the ocean blue.

SILVER LINING

There’s a beautiful thing about America… the rules largely apply to everyone. Not always, but largely.

The problem is, the wealthy just know them better than us.

*If you don’t believe me go live in any developing country.

HOW DO I HAVE A BILLY DOLLAR IRA ALREADY?

Thiel’s Master Plan

- 1999: Opened a Roth with $1664 in early Paypal days

- 1999: Bought 1.7 million shares of Paypal for .001 cents a share, total $1700. So he essentially in a bunch of shares of the stock he owned. This is where it gets tricky, you have to make sure they are valued properly. You aren’t undervaluing them.

- 2002: Paypal acquired by eBay and his Roth worth $28.5 million

- Since then he’s invested in innumerable companies and deals from his Roth so the proceeds are exempt from federal tax.

Invest Like Thiel

(Should we get t-shirts made ha!)

How can you get the SAME benefits as Peter Thiel in your retirement accounts as a normie like me?

Step 1: Don’t just put in money, put in assets that will grow.

If you make under $140k (you can do a Roth IRA), if not sorry no go. BUT I still do many transactions in my self-directed IRA. Will explain more. Most people put in mutual funds and standard assets that might grow at 7-10% a year. Peter Thiel, Buffett and a bunch of billionaires put in stock in private companies with the ability to 10-100x. So instead of stocks and bonds, he used alternative assets, private company shares or real estate. BTW – available to all people not just billy’s.

Step 2: It’s Called A Self-Directed IRA or 401k

The way you invest in these types of assets is through a self-directed IRA. Never heard of it? Most people haven’t, why? Big custodians (Vanguard, SSgA, Schwab, etc) will never tell you about these. Because you can invest in items off their platforms. It means more liability for them and fewer fees collected. So they don’t talk about it.

Some of the large Self-Directed IRAs (Roth = pay taxes now, no taxes later, Traditional IRA = defer taxes until your 59 1/2) are:

- Equity Trust.

- IRA Financial.

- uDirect IRA.

- The Entrust Group.

- Alto IRA.

- Rocket Dollar.

For instance, early on, I invested in Real Estate through my Self-Directed Roth IRA, I invested in a few PE deals, a few angel investments. I don’t have billions or millions in there but given the HIGH risk I have of losing money in these deals the ability to defer tax is very intriguing. SO IF YOU ARE YOUNG or Don’t make more than $140K, worth looking into.

Step 3: Angel Invest Through Your Roth

You invest in private companies or startups through your Roth IRA. As those assets grow you keep investing into more high risk assets with the potential for big against.

The article explains Private Deals or Angel Investments as “a scenario only a few have access to,” but the truth is we all have access to them. Except that the GOVERNMENT doesn’t allow non-accredited investors (people with less than $1M in income or $250k to invest in private deals).

But today more than ever you can invest in private deals through:

- Angellist

- By following tech twitter and asking to invest alongside them

- By investing in rolling funds on Angellist

TAXES = COMMAS

My mentor reviews EVERY YEAR with her accountant, the new allowances in the tax law. This has allowed her to buy cars basically for free after write-offs (that’s why you see so many G-Wagons, if a car is a certain weight and used for business it can be a write-off). I now have a tax accountant and a strategist. Why? It’s complicated but in the rules are written the entire game.

If you have one resource on it, I’d say Tax Free Wealth. Worth every cent of the $16.42 to buy the book.

In summary, don’t hate the player, hate the game.

Question everything… even the tax man,

Codie