I have this theory: we have to unlearn the things we were taught in school.

No one teaches the real classes we should be taking.

For instance, I worked on Wall Street, I went to a top tier(ish) school (Georgetown), I got an MBA and PhD (although my doctorate was in Brazil so mostly I majored in samba, cachaca, and bad decisions)… AND YET no one in all those big company training programs and overpriced schools taught me:

- The only way to create real wealth is through ownership not employment.

- How taxes work on long term capital gains vs income.

- Why CEOs will take salaries of $1 and the rest in stock options.

- That it may be better to make $800k as a non-W2 employee with the ability to do write-offs than earn $1MM as a W2 employee.

- About the 1031 exchange in real estate.

- How opportunity zones work and how to use them.

- And for all those people who use turbo-tax to do your own taxes, I’m so sorry to tell you, but you’ve probably missed tens of thousands (on the low end) over the years that a smart accountant could have saved you.

The real system that keeps people down is the pittance that we call education and the way we tax as a society without teaching people how to maximize the tax code. Those who have means pass on to their children true education, the language of money.

A good friend, Nely Galan, was the first woman President of Telemundo, Emmy award winner, best selling author and she created hundreds of top ranked tv shows. Even she says she made more money in business and through reading the tax code from front to back each year, than she ever did in media.

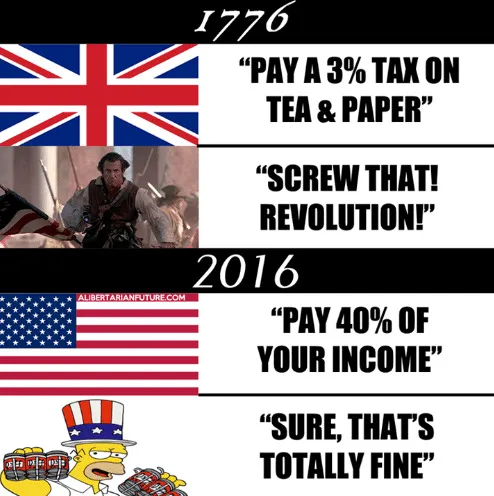

Sidenote Rant: If you live in California and you are at the highest income bracket that’s a tax rate of 49.3% of your total income. Remember: We started a revolution for a 3% tax on tea. Just ruminate on that for a second.

But I digress, this newsletter is on Buying Real Estate and why I think income properties are overrated.

Let me tell you why it’s so much more interesting to look at other income stream vehicles.

But first a disclaimer: I own a decent amount of Real Estate. I use it for income, for appreciation, for diversification. It’s important as part of your portfolio, BUT I think rental income properties are highly overrated these days at the scale most of us can afford to do it. I’m not continuing to allocate unless I get a massive massive discount, for a couple of reasons.

First: TIMING IS NOT AWESOME.

No one is great at predicting highs or lows. Including me. But, this graph doesn’t look fantastic.

Seems like maybe, possibly, potentially, could be a high for commercial property prices, eh?

Now I’m not a rocket scientist, but I am trained in economics (whatever that’s worth these days), and to me these do not look like screaming deals.

Juice Ain’t Worth the Shake

But maybe I am dead wrong. Maybe it’s a wonderful time to buy real estate and all those millions unemployed will have no hangover effect whatsoever on the housing market. Insert eye-roll.

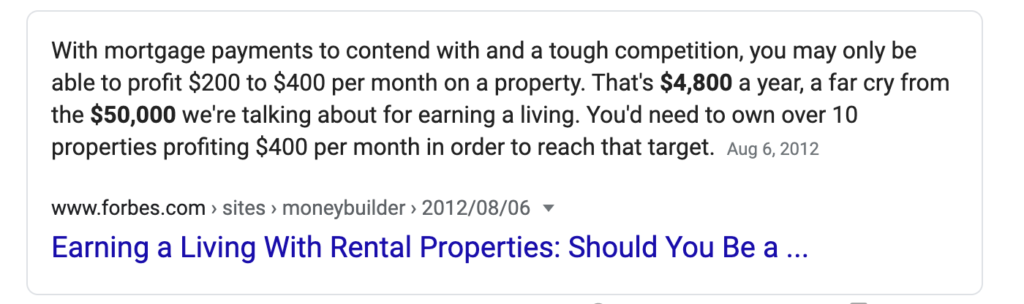

Well then, even during 10+ years of a bull run, look at the average income made on rental properties.

Forbes says the average rental property owner takes home $400 a month. Hard to live off that kind of cash flow.

If this above is true, you’d have a rental income balance sheet that looks something like this (if by some miracle you find a place this inexpensive, with a high rental income payment percentage aka no defaults):

Now you could add in appreciation of 3-5% per year which is the average for real estate, but what you are really doing is buying your kids a big huge future present. You are not buying yourself passive income.

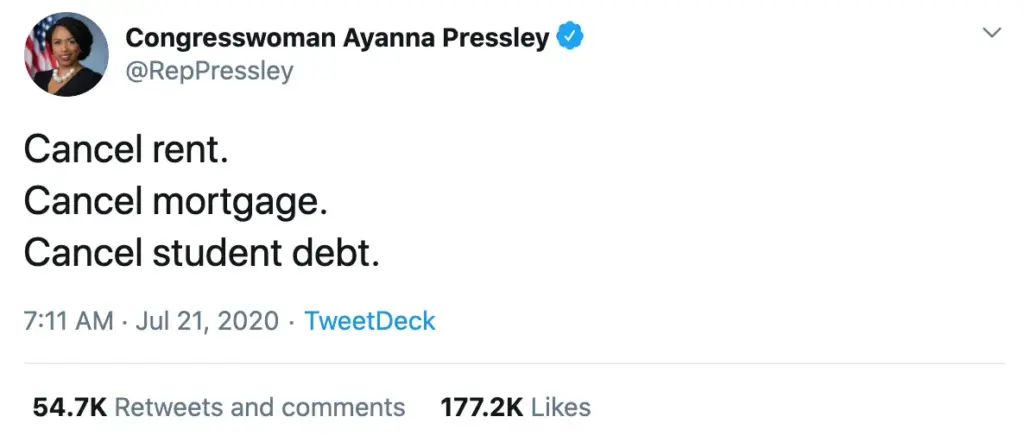

Last Comment: Cancel Rent?

Also if this tweet doesn’t scare you, you aren’t paying attention. Especially if you own property, or you know, like not living in a place like Venezuela.

That’s a congresswoman who obviously took liberal arts classes and skipped economics. Canceling rent and mortgage sounds like an awesome way to make sure those who need to rent can’t afford it. After all, would you be a landlord if you can’t recoup the costs? No rent = all cash rent required by landlords up front. I’m all for canceling mortgages theoretically, I have a few of them, I’d be a big beneficiary. But second and third order effects would mean no one could buy houses without cash, aka Venezuela.

Well Codie, That’s Depressing, What’s the Solution?

Over the last couple of years, I’ve been obsessed with unconventional ways to build wealth and passive/active income that doesn’t require a ton of upfront money or a large loan for such a small cashflow.

My answer: buying small profitable businesses.

I believe in 20 years we will look at it similarly to buying real estate. It will become “processized” and be another asset class in our portfolios. We can get America back to work, no thanks to our politicians, while also profiting and bringing more into the ownership circle.

Couple reasons why:

Supply & Demand Are Your Friends In Small Business Buying

There is a record number of small businesses for sale across the country as more Boomers retire and more people tire from their long grind of starting a business to scaling it. Not to mention amidst Covid-19, riots and shutdowns.

To be precise:

- 2.5MM small businesses

- Most won’t sell within 12 months (1 out of 9)

- Disaggregated market with fewer buyers than sellers

And when there is a record number of supply that means a pressure on price. The truth of it is most people don’t know about how to buy a small business.

They don’t know you can:

- Use an SBA loan to finance your entire purchase

- Use seller financing to not put a $ down

- Use value added work to get equity without a cash/loan exchange

Most people when they are feeling froggy, go and start a business. But it’s high high high risk, a 96% failure rate.

Think of it like this, you largely don’t buy pieces of land and develop them yourself as a newcomer. Just like people probably shouldn’t do a startup from scratch for cashflow. First you go work in a business, then you buy one, and then you look to develop one from scratch. Maybe?

Or maybe you just keep buying and combining them to create businesses so scaleable private equity firms come knocking.

The next reason is, you usually buy real estate for cash flow, but honestly, real estate is one of the worst ways to get cash flow.

Big Up Front Cost & Little Margin

JUST SO MUCH MORE PROFITABLE TO OWN A BUSINESS THAN A HOUSE.

25% down for a mortgage and $400 a month to deal with all the broken pipes, sketchy tenants, lightbulbs out, and wear and tear on the house. Is that really worth it?

There are lots of characteristics we need to dive into but suffice it to say:

Businesses we want net you at least $100k a year in profit.

That means more than $8,000+ a month to you the owner.

That is a 1983.25% increase from $400 a month with rental properties.

Not too shabby, eh? Not to mention you cobble a few together and there is this beautiful thing called scale that happens with more than one business. Leverage same sales team, same accountant etc.

It takes a little more work to learn the ropes than just going out, grabbing a realtor and looking for places. But, it also doesn’t take 25% down and a very teeny tiny itty bitty margin of profit.

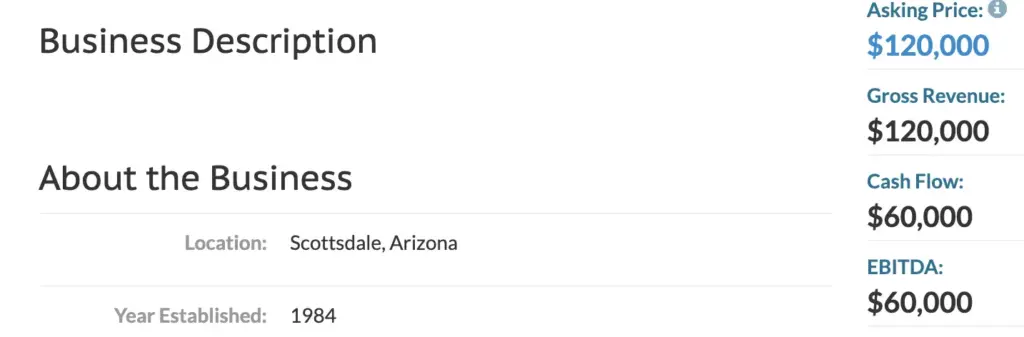

Here’s one business I’m moving to buy. A coin operated laundromat. Did anyone else think it was laundrymat? Laun-dro-mat makes zero sense. Just me?

(Do you already own a laundromat or are you looking to acquire one? Take your business to millions in revenue! Click here to learn more)

Back to the program, so asking price is $120k, profit is $60k a year. We’ll negotiate it down to $80-100k, we’ll use seller financing so we don’t have to put money down and anything we do put down we could even get an SBA loan on (especially as vets and minorities). But Codie, it’s only $60k. YUP! However I’m going to buy a few. Which means as I aggregate them I am more in the $300k profit range. I’d recommend starting smaller for your first venture. Training wheels and all that.

And my fiancee can be the coin man, jingle jingle, with a few contractors locking up and cleaning.

THAT is the POWER OF PROFITABLE SMALL BUSINESS BUYING.

High Margin, Low People Businesses.

Anywho – bunch of you asked so we made a course on all of this and a mastermind called Contrarian Community. It’s not for the public yet, only on preorder so feel free to follow along.

Our mastermind should be fun… it’s for all you fellow nerds who get bored by convos that go: weather, covid, kids, covid, protests, covid, hate trump, covid, Biden’s got dementia, covid. So boring.

For those of you who want to build wealth the unconventional way. Come along for the ride.

I talked my wildly more intelligent friend Ryan into hosting it and I’m along for the deal flow as well as the cash flow.

Almost everything else I do is long term: venture capital investing, angel investing, long term real estate holds and building startups myself. You have to barbell your income to set yourself up for some home runs AND more singles or bunts (is that just a softball thing?).

As always, question everything and stack revenue streams,

Codie

I’m experimenting with Twitter talking about Contrarian arbitrage; investing, income stacking, biz building unconventionally on a lot so let’s connect.