And a very Happy Holidays to you and yours, from all of us at the Contrarian Thinking team!

But first, going viral with vending…literally. We sent a beacon out into the TikTok-sphere and she responded pretty loudly! Check it out here.

Today in <10 Mins We’re Diving Into:

- Why unf*ckwithable?

- What does it mean?

- The 5 R framework -> Where to begin

- Your investment thesis -> How do you know when the deal is the right one for you?

Why Unf*ckwithable?

It’s not, technically, a word (we checked). There are many reasons, but here’s probably the single most significant one as I write these words.Yes, ladies and gentlemen, boys and girls: INFLATION.

3 Problems w/ Inflation:

1) We don’t understand it

2) We get lied to about it

3) We don’t know how to handle it

What is Inflation Today?

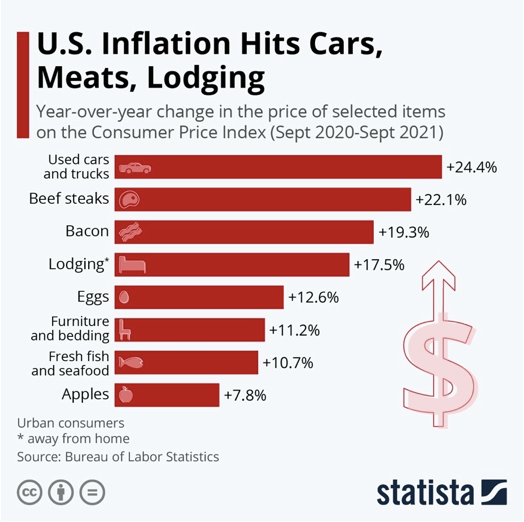

In a world where gum costs $6 and something previously more expensive than gum costs, well,

THIS MUCH… ⬇

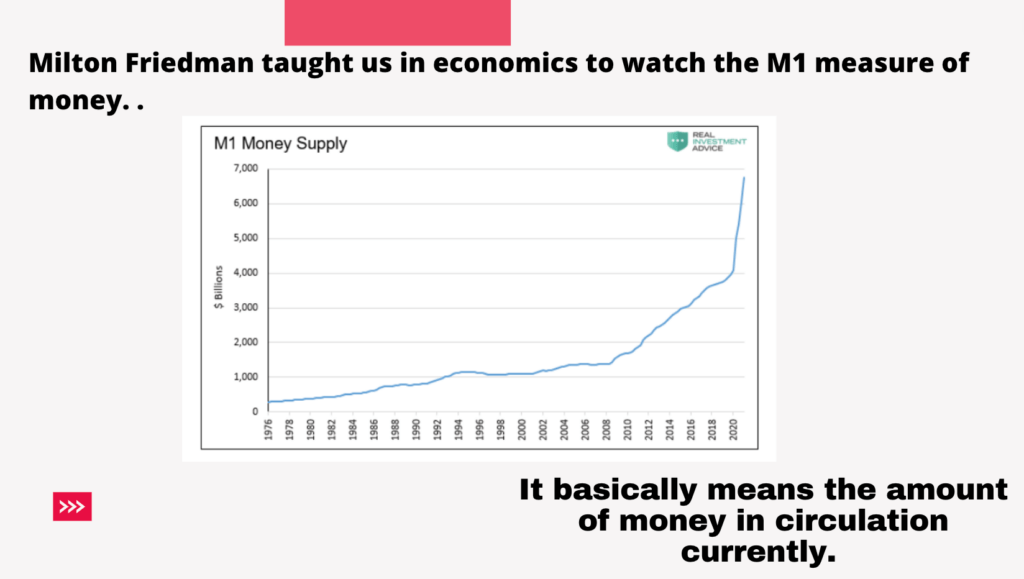

So, with Covid as a proximate cause, America has flooded the marketplace with dollars and the results are inflation. Do you see that blue line going up and up and up since COVID hit in March of 2020?

That’s $$ in circulation (or as economists dub it the M1 and M2 measure of money). It shows that the velocity of money circulating in the system is going faster and faster.

All of which leads to an increased supply of money chasing the same number of goods.

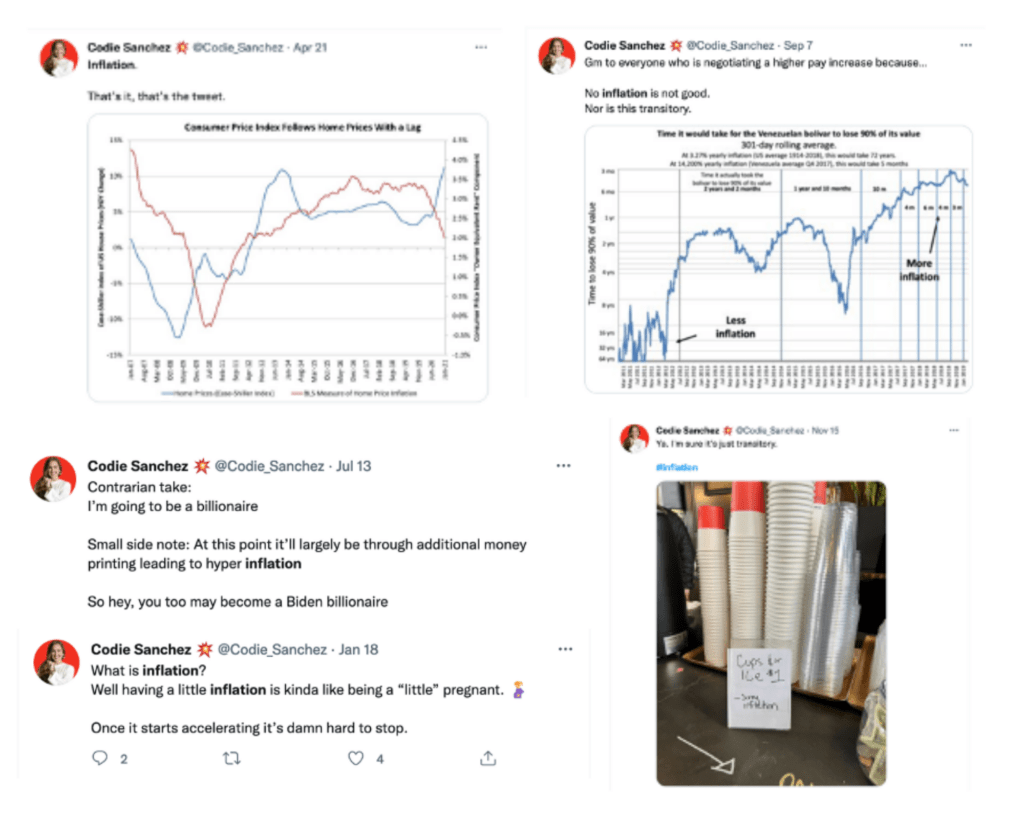

Lied to About Inflation?

Inflation is a government-caused problem historically, which means we can’t rely on govt statistics like the CPI to diagnose or remediate it. That gets tricky for those of us trying to handle inflation.

In places with high inflation… censorship and denial are the rules, not the exception. Once you realize the government is not incentivized to tell you they’ve slowly burned your money away you realize you need a plan before others.

Despite Chairman Powell’s recent Congressional testimony where it just dawned on him that one can accelerate massive spending without consequence, we here at Contrarian Thinking have seen the proverbial writing on the wall for quite some time.

“I told you so’s” are annoying for the sayer and the hearer so we will skip that and get back to my original point and the title of this article: becoming “unfuckwithable.”

Our goal today? Give you a plan to WIN regardless.

How to Deal with Inflation: Becoming Unfuckwithable

First, let’s define the desired outcome. Here’s our first cut:

Unfuckwithable [un-FUCK-with-able]

Adjective-

- A descriptive term for a person who wins, without letting themselves or others get in their way

- Someone who can continue covering all your costs at pace with inflation IF your salary stops

- Someone who can move as needed due to regulations or desire, without detrimental financial impact

- Someone who can live in a way that if another lockdown happens you have access to your own needs; food, fresh air, nature, gym, or whatever is important to you.

In fewer words, unf*ckwithable is FINANCIALLY FREE and PERSONALLY SOVEREIGN.

I have a few frameworks I have used over the years, we must begin with our foundation. Here’s what I call…

The 5 R’s to Sovereignty.

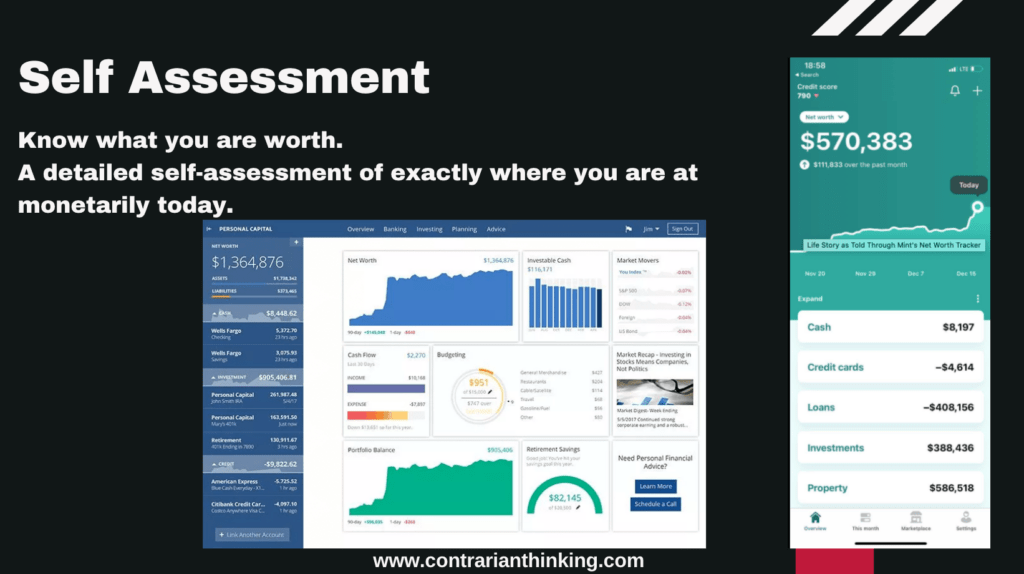

- Review: Know what you are worth. A detailed self-assessment of exactly where you are at monetarily today. You cannot, as they say, get anywhere if you don’t know where you currently are…. This doesn’t need to be difficult. A Mint account and an Excel spreadsheet are a beautiful start.

2. Reason: Ask yourself why you are invested in what you are invested in? With this clear picture of what you are worth, look at your investments and can you articulate to yourself WHY you own it. A simple 5Ws + HOW of WHY you are invested in certain things might look like this:

a. Who: Who are you investing in?

b. What: What is this asset in terms of your larger portfolio and what do you hope to achieve by having it?

c. When: How long do you want to stay in this asset? When might you consider it a poor investment and move your capital elsewhere? When do you want to take profits and how long will you let your winners run?

d. Why: Why do you have a particular allocation to an asset? Why is this asset 20% of your portfolio and another one only 3%? Do these allocations match your overall goals?

e. How: How does the asset fit into your larger financial goals? While these are only examples, you get my point.

You need a portfolio-level view of your own investments, regardless of the ‘flavor’ (Real Estate, Vending Machines, Power Washers, Stocks, Child Labor camps (you’re still reading, I see…), etc) of those investments.

3. Realize: Build, or refine, your strategy. Now that you know what you’re worth, and WHY you’re invested in certain things, build a numerical strategy. Perhaps it’s something like:

I want $400K/year, have $100k in passive income, and have a $100k cash allocation that’ll cover 12 months of emergency capital needs.

A want is worth nothing without a plan. Now you build your plan to achieve your want.

a. Start with what you need your investments and income to be this year

b. Then break that down to monthly

c. Then weekly

Most of us, by the way, do this for our business ventures and yet not for our personal. Who doesn’t have a spreadsheet, tracking system, or SAP output that tells them what they want their business to earn each month? Where we FAIL, friends, is we stop at our business and we neglect the rigor necessary to get these same types of details for our PERSONAL wealth.

4. Rules: I don’t know about you, but I can be phenomenal at ideas and then abysmal at continual supervision and execution. So, I work myself out of a job by building a rules-based system that helps you hit the goals you laid out. For me, that means:

a. I have a quarterly review with my financial advisor

b. I review my finances on a monthly basis in my net worth spreadsheet

c. I iterate with spending and investing according to my plan

Build your own rules.

- Roadmap: Essentially this is your investment thesis. What’s an investment thesis? These guys know…

In simple terms, an investment thesis is a way to evaluate whether a deal is right, for YOU. I like to evaluate my deals using the following factors:

- Where: Is it in an asset class that allows you to tax loss harvest? If it’s a physical asset, is it in the best physical location to make you the best ROI?

- Type: What is the type of deal you want to go into? Angel, VC, Fund, Stock, etc.

- Profit: How much profit will this deal need to make for you to be involved? Is it worth it to you to make 5K a month? More than 200K a year? What’s your number?

- Time: How much time are you willing to allow your money to be tied up?

- Turn: How quickly will you get cashflow? Even though my overall investment is tied up, when will I get my initial cashflow?

- Team: Do you want to be in business with the people on the other side of the table? Are they the kind of people you trust? Do you think they are good, decent, fun, interesting people that you won’t mind talking to on a regular basis? If they’re not, you’re looking at the wrong deal.

- Process: Do the people you’re doing the deal with understand the business you are partnering on?

- Unfair Advantage: What do you bring to the table that no one else does? Or what do they bring?

The bizarrely beautiful thing about life and money is that the things we need to do to progress are rarely rocket science.

You would like to lose weight?

- Eat less, workout more

You would like more money?

- Spend less, work more

Nuances there are plenty, but the truth is that the simple steps taken daily will often lead you exactly where you need to go.

So go earn and become unf*ckwithable,

Codie

The Winner of the Mind, Body, Bank Giveaway!

Congrats to our big giveaway winner, Tanner Enderle! He added an Oculus, Apple Watch, 3 top books on investing, and $1k cash to the list of things he got for the holidays.

Missed this one? That’s okay! You can always win cool prizes by helping us spread our word. If you want to participate, you can subscribe to the free contrarian thinking newsletter and share your unique referral link with family and friends.