Today in 10 minutes or less, you’ll get:

- Mental Model: High ROI to low a** pain

- A systems engineer who was burnt out at his 9-to-5 job, and then thumbed through a copy of Rich Dad Poor Dad…

- Who started buying up rental properties while building his corporate escape route…

- Who then gave his two weeks and scaled up a portfolio of 155 rental units under management…

- And ten years later; has $2.5+ million in AYR, 700+ units, and a team of 22 people

MENTAL MODEL

Lost decades:

Before you do any deal the first question is… what is the downside?

The world is getting rough. The recession is largely here, as is inflation, and will most likely worsen. We’ve really only experienced short recessions a la 2008 where we had a v-shaped recovery. Basically, it went down fast and come up fast. But that’s not always the way.

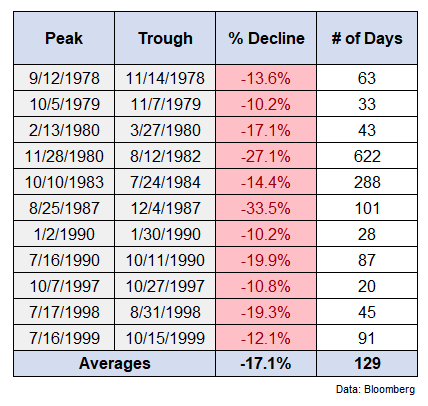

Look at the period from 1977-1999:

That is 10 years of negative returns or largely flat markets. Over the coming weeks, we are going to talk about investment context. Given what is coming, what’s the best way to prepare? What if the worst happens?

The idea today is one that can weather down markets, because we are here to free humans, not to get rich quick. We are here to become owners, not to speculate. We are here for you.

Buckle up. This one’s got your back.

PETER’S STORY

So you’ve probably heard my spiel about property management before.

You start with one, then you’re obsessed and start collecting them like Pokémon cards on the playground.

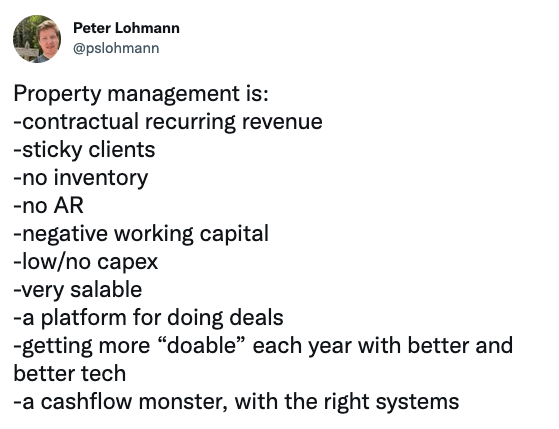

There are A LOT of reasons to love getting into this kind of biz.

- You can scoop up properties and renovate them on the weekends, all while working a regular job.

- Rent’s always due on the first with minimal upkeep once your unit is rented out.

- It’s easy to scale with the right software to manage contracts, payments, and maintenance requests.

HOWEVER – it can be a nightmare to run these things if you are unorganized and don’t have the right processes. This is where Peter comes in, he was an engineer, but we’ll get to that later.

Peter had “The American Dream”, or so they say.

Back in 2008, he was working his engineering job. He’d worked his whole life to get there.

But then plans changed.

It all started when he picked up a copy of Rich Dad Poor Dad. A few pages in, he saw that the true path to financial freedom was in cash flowing.

Not just from a salary or golden handcuffs. Assets.

Peter took to Google and learned that in Columbus, Ohio, (where he lives) there weren’t a lot of property management companies. Bingo.

So that same year, Peter bought his first single-family foreclosure using conventional bank loans with plans to scale.

He was contracted to pay 20% in interest and used the years of savings he’d built up from his engineering job for the down payment. But then he ran out of cash shortly afterward. He didn’t have enough money to keep buying property after property himself. So he decided to become the defacto middleman between investors who were buying properties and renters who were looking for homes.

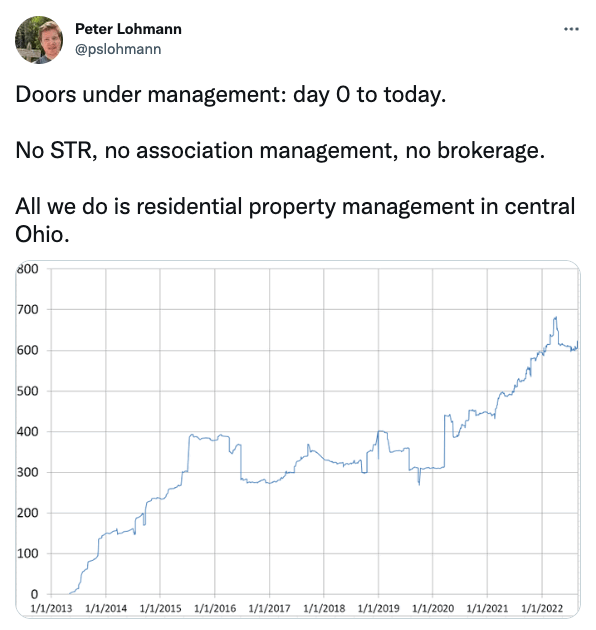

Image source: Twitter

Part of the appeal of this kind of business comes down to making consistent income. Back in 2013, Peter was pocketing $100 a month per unit (so ~$15.5k a month at the time).

Before he hired a team, his overhead looked like ~$1,500 per month plus whatever he’d decided to pay himself.

INSIDER TIP – Here’s how to find your first few rental properties:

- Do a hell of a lot of networking – head over to Meetup and search for real estate investing groups in your area or get active on the Bigger Pockets forums

- Get resourceful AF on social media – Your first property could be a tweet away. If you’ve built up a professional network over the years, you’ll probably have more luck sending a DM to a contact than putting in a random bid somewhere.

- Invest in Google Ads – even a small ad spend of ~$300 a month will drive traffic to your site if it is highly localized.

I’m not saying Peter has all the answers, but the guy was a systems engineer.

Systems + Engineer = the opposite of Codie’s unorganized chaos. The biggest hurdle to running your own property management company is the systems. But if you want to see them even more tightly broken down (and maybe even steal them)… you’re going to want to click here.

A few notes from his playbook on how to manage rental units without making your head explode:

- Lean on software to make your life easier – Peter’s got one “Can’t Live Without” when it comes to computer-y things that make managing rental properties easier. Buildium is a property management software that helps you streamline all the paperwork things (think rental agreements, maintenance requests, and payments) all in one place.

- Rule of three – Every time you do something that has more than 3 steps, more than 3 times, you document it. Peter’s notion document is a thing of beauty. Every question answered, every process outlined, every plumber and landscaper listed and ready to call.

- Be an 11/10 with your people management skills – One thing I see people get wrong about rentals is that they think it’s about getting good at managing the units. It’s not. This is a people business. You need to have a sixth sense when it comes to people. Or you need to build out a checklist of what makes great vendors and renters in your world. Peter documented his questionnaire to figure out who he really wants to work with.

- Play the middle when it comes to rental quality – Peter says this last part is true in Ohio, but my guess is it’s actually true pretty much anywhere you’re looking to get into rentals. Basically, your tenants want cheap rent and a lot of improvements to the property. The rental owner wants high rent and little to no improvements. The trick is to be the middle man—find a rent price that fits with your ideal tenant and make (reasonable) renovations to your property.

I don’t want you to get caught up in the dollars, because owning a business like this is still a lot of hard work BUT it cashflows. Image source: Twitter

If I were going to get into building up or buying a big rental property management company, here are a few ways I’d hack it:

- Elevate your ideal tenant by partnering with a local realtor you trust. It’s a win-win scenario for you. Realtors want their tenants to find a great property, so they’ll score more future clients through referrals. You want tenants who are high-quality, won’t complain, and won’t damage your property. A realtor can sniff these out for you (instead of finding randos from Craigslist).

- Double down on scaling out your systems. After all, nothing you do for a rental property should ever take you longer than 10 minutes. Sending over a client contract? 3 mins or less. Filing a maintenance request? 30 seconds tops. If you’re not into being in your inbox, then having systems in place to manage the day-to-day is the key to getting sh*t done without taking up a ton of time.

- Give back. You can also work with local agencies to help you source tenants that are in need of housing assistance and a safe place to live (think: leaving a domestic abuse situation). If you’re into this, you can find an agency that will (usually) fund the security deposit and the first few months of rent in scenarios like this.

- Steal his systems. We’re doing something interesting for the first time and partnering with Peter on his systems too. More on this below…

TLDR

If you’re still working a full-time job and playing the investment long game, getting into rental property management could be your key to cash flowing.

And before you hit reply and tell me this is a bat sh*t crazy idea because of the R-word (recession), hear me out.

The economy is gonna do what it’s gonna do. It goes down, it comes back up again. This is the way it works. We know this.

But that’s why buying then building a business is so important. In an economy like the one we’re getting into, you can build up some steady (dare I say safe-ish?) investments that could also equal some cash flow on the side, even if you’re still working full-time.

Now I wanna know, what Q’s do you have about investing in real estate like this? Hit reply to this email and then hit me with your questions and I’ll add it to my list to ask Peter for a future YouTube video.

CONTRARIAN FINDS

F*** mainstream media, read these instead:

Top 3 places to buy businesses:

Flippa – For the best online businesses and curated deals sent to you daily, weekly or monthly, sign up for Flippa’s ‘The Deal’ newsletter!

BizBuySell – Terrible UI, awful colors, crap to sort through BUT the biggest spot for buying businesses.

Loopnet – Also horrendous to anyone who even marginally likes design, but great for buying mobile homes or RV parks.

CONTRARIAN EXTRAS

The Not So Boring Section:

- Kanye Quest – Looks like Kanye West is buying Parler, a conservative social media platform.

- Grocery Juggernaut – The multi-billion $ merger of Kroger and Albertsons may change grocery shopping forever.

- Persistent Pain – The IRS is adjusting tax brackets due to inflation.

Until then? Cheers to cash flow, my friend.

Codie & Contrarian Crew

Written by Kendall Cherry, Codie Sanchez. Edited by the Contrarian team.