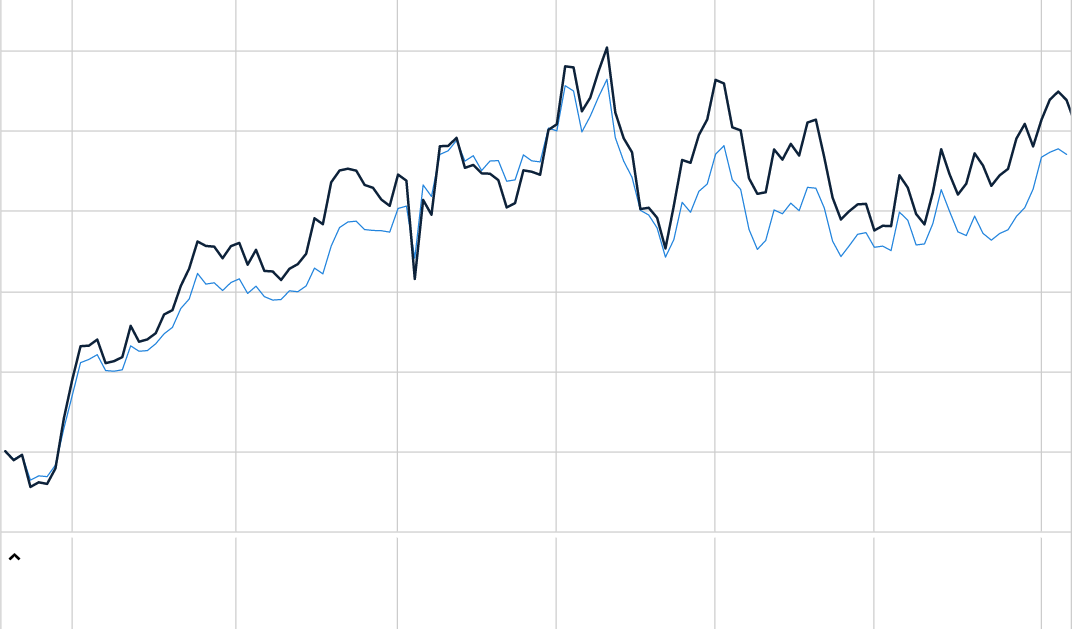

Move over Tiger Woods, there's a new Comeback Kid. Tom Stanley is the manager of the Resolute Performance Fund, a strategy he has been managing continuously, in various guises since 1993. For a while he had a phenomenal track record and reputation, culminating in a 2005 Report on Business Magazine cover calling him "Tom Almighty". Then he had disastrous losses in the midst of the Global Financial Crisis. He then spent several years of desert wandering. But since 2016, he's making up for lost time: up 63% in 2016, 65% in 2017, 70% in 2018 and 64% year-to-date. Multiply all that and Tom Stanley has delivered near 8x returns since 2016.

These numbers are so incredible, that I might have titled this post, Move over Jim Simons, there's a new secretive guy with crazy numbers. But Tom tends to be more volatile, not a money-printing machine like Simons. He regularly alternates between being top percentile and bottom of the barrel. I forget his drawdown post-2008, but he went in loaded with energy and uranium stocks, so you can imagine how that turned out. At one point, the fund was 90% in energy stocks.

I could not initially find full performance data on Resolute's website, so I sent a query saying I needed to put his 8x returns in full context. Then today, I was able to find it on the website, so I'll take credit for that or maybe I was initially incompetent at browsing websites. I must give credit where credit is due: Tom's latest fund (incepted June 2005) is compounding at 15%, despite his difficulties with the commodities crash. The comparison with Tiger Woods is imperfect because Tom Stanley is into clean-living: he believes in prayer, tithing and I think he has 7 children. Though like Tiger, he probably has a bad back from all the reading he does.

His first fund delivered 29.63% CAGR between 1993 and 2006. That fund only closed because Tom didn't like its legal structure. So put those two track records together and you have some incredible numbers.

To be clear, OPM Wire, despite our unusually enthusiastic tone here, cannot endorse this fund. I’ll leave that analysis for another day, but in any event, we can’t endorse 99.99% of financial products out there, so that’s not saying much. But I have to respect those high numbers delivered over 25+ years (though they were achieved with great volatility). It is said that in investing as in dieting, the plan that works is the one you stick with. Congratz to investors who stuck with Tom Stanley, if any.

Two other updates I wrote about Tom Stanley: