Magnesium gummies, 4K video editing, +2 more trends to take advantage of

Exploding Topics scours the internet to find emerging trends before they take off.

Here are four of the latest developments, along with some insights and analysis to help you take advantage.

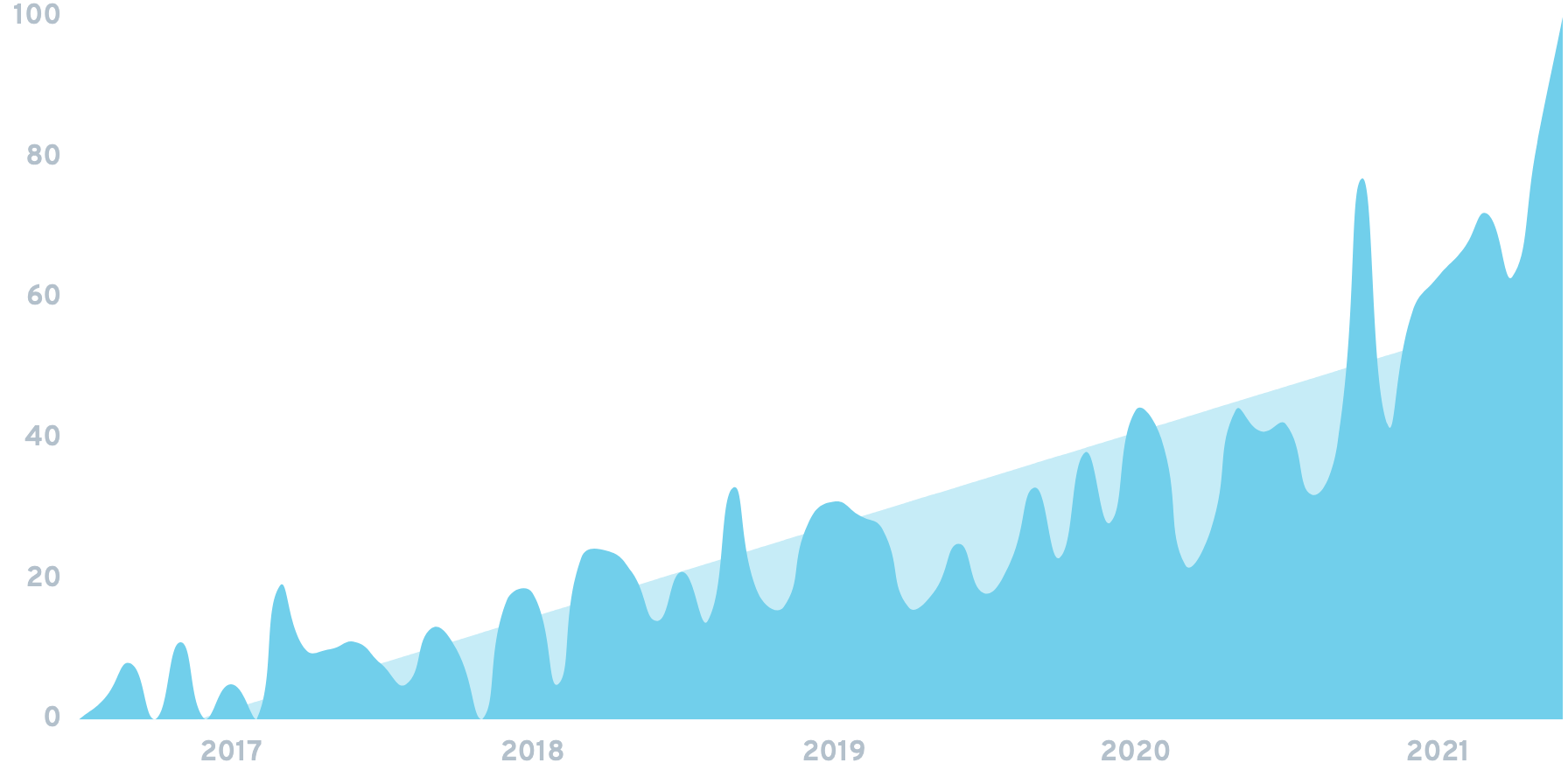

1. Magnesium gummies

Magnesium gummies are high-dose magnesium supplements in gummy form.

Studies suggest that up to 75% of people don’t meet their recommended daily intake of magnesium.

Which is leading to increased demand for magnesium supplements – including gummies.

According to a report by retail analytics company ClearCut, the magnesium supplement category on Amazon has grown from $8M to $14M over the past two years. And that sales of magnesium gummy supplements have grown by 130%.

What’s next:

Magnesium gummies are part of the Gummy Supplement meta trend.

Gummies are becoming the de facto delivery system for a wide range of vitamins and nutrients.

(In fact, vitamin gummy supplement sales are up 60% YoY.)

For example, the ACV gummy company Goli Nutrition reports that their brand of apple cider vinegar gummies are now “the single largest health product SKU”.

Other growing gummy product categories include sleep gummies, hair gummies, turmeric gummies, and collagen gummies.

Get new trending topics in your inbox:

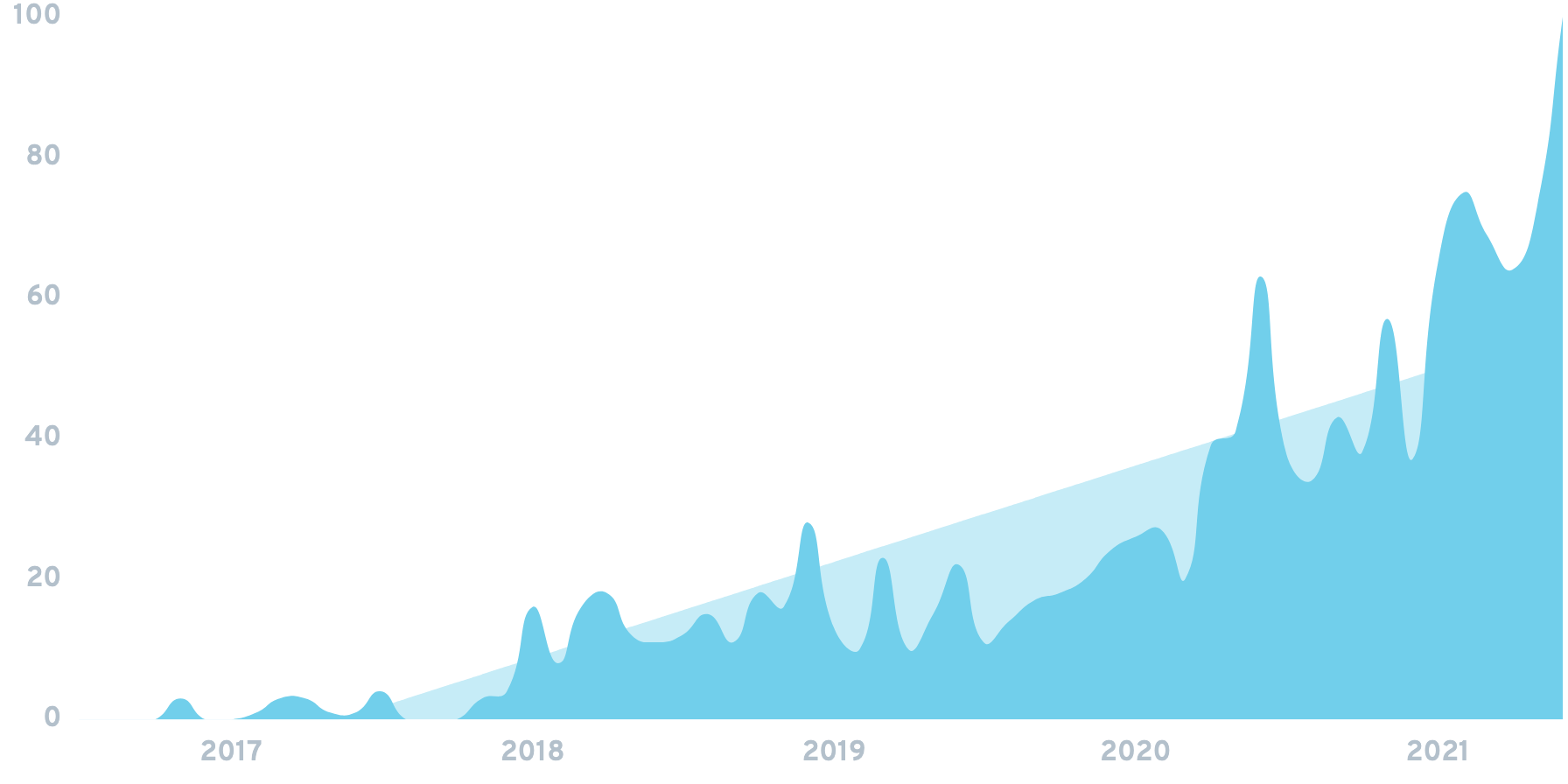

2. Bokksu

Bokksu is a Japanese snack subscription box.

Themed boxes are sent out each month, with snacks sourced from a range of local Japanese makers.

In 2016 Bokksu had 40 subscribers. By the end of 2018, that number had hit 10,000. And has now risen above 20,000.

Alongside that customer growth, revenue has jumped from $400,000 to $4.8M between 2017 and 2020.

And notably, unlike most subscription boxes, 15% of Bokksu revenue comes from one-off purchases.

What’s next:

Bokksu is part of the subscription boxes meta trend.

McKinsey estimates the subscription boxes market is worth $15B.

According to SUBTA, there are 18.5 million subscription box shoppers in the USA alone. And 35% of these buyers have 3 or more active subscriptions.

Bokksu occupies the second-largest subscription box category: food.

Subscription food box websites get a collective 150 million visits per year.

Up and coming food box companies include Flaviar (liquors), Snackcrate (global snacks), Crowd Cow (meats), and Love with Food (healthy snacks).

But it’s beauty subscription boxes that receive the most combined traffic – with over 216 combined million hits.

Scentbird is an established player in the space. The monthly designer scents subscription box has raised $28.7M in funding and generates an estimated $20.9M in annual revenue.

But new brands in this category are growing fast, including Roccabox, BoxyCharm, Clean Beauty Box, and The Natural Beauty Box.

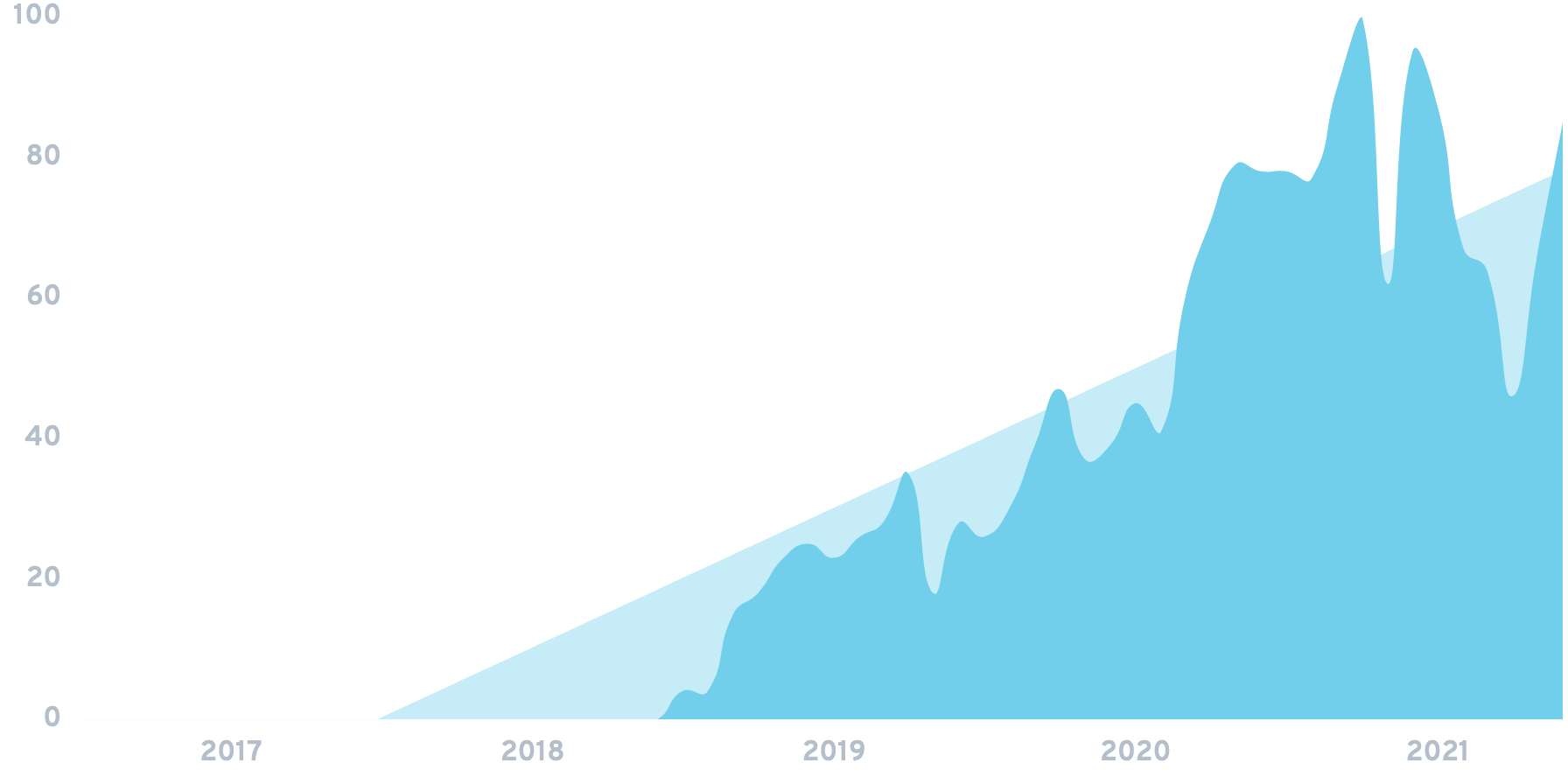

3. VideoProc

VideoProc is an editing suite specifically for 4K video.

4K video is a fast-growing market, with more than 214 million 4K consumer products shipped last year (Statista).

VideoProc’s GPU acceleration is designed to speed up the processing of high-quality video up to 47x. Which means the software can be run smoothly on most standard hardware.

Which is why VideoProc has amassed 4.5 million active users across 180 countries. And this number is growing 1.5x year over year.

Digiarty, the company behind VideoProc, has an estimated annual revenue of $15M.

What’s next:

VideoProc is part of the “video editing for the masses” meta trend.

VideoProc and direct competitors like Movavi and DaVinci Resolve are growing in popularity because they make 4K editing accessible to non-professionals.

There’s also an increasing number of mobile-based video editors.

At least 85% of all photos are taken on smartphones, and video is moving in a similar direction.

For example, YouCut has over 50 million downloads on the Play Store.

There’s also Videoleap: parent company Lightricks has raised $205M in total. And has an estimated annual revenue of $44.1M.

Other rapidly growing mobile video editing tools include KineMaster Pro, InShot, and LumaFusion.

The video editing software industry as a whole is expected to rise to $1.1B by 2025 (from $850M today).

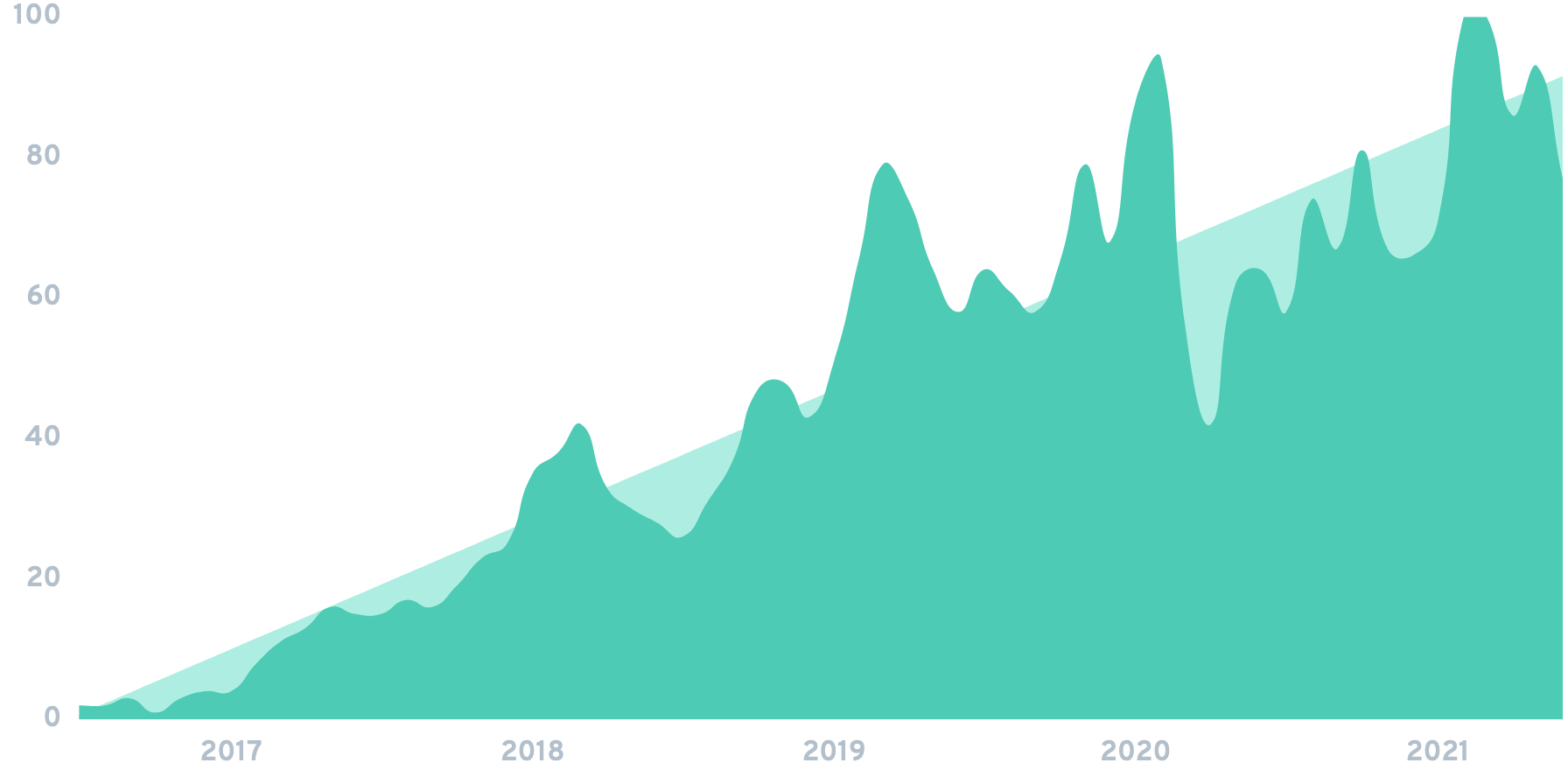

4. Plasma pen

A plasma pen is a device used to deliver plasma fibroblast therapy — a procedure designed to tighten skin, reduce acne scarring, and lessen fine lines.

Plasma pens direct small amounts of electric current to create “micro-injuries'' in the skin. Which triggers increased collagen and elastin productions.

According to a review published in The PMFA Journal, plasma fibroblast therapy can improve the aesthetic appearance of the skin, encourage tissue regeneration, and tighten skin tissue.

The therapy can be performed at spas as well as cosmetic surgery centers. Regulations about who can perform the treatment vary widely by state and country. There are also a growing number of DIY plasma pen kits on Amazon.

What’s Next:

The plasma pen is part of the “non-surgical cosmetic procedures” meta trend.

The COVID-19 pandemic actually increased demand for cosmetic procedures. Plastic surgeons have reported up to a 30% increase in procedures compared to the year before.

However, many of these procedures are now being done at home.

Examples of popular at-home cosmetic procedures and products include LED face masks, hydrating sheet masks, microneedling, hair clay masks, and dermaplaning.

Get new trending topics in your inbox:

🔥 Roast My Landing Page

🔥 Roast My Landing Page