Small Business

Intuit QuickBooks Report Shows U.S. Small Businesses are On the Road to Financial Recovery

A new report by Intuit QuickBooks provides one of the most complete assessments available of the pandemic’s impact on U.S. small business revenue and indicates U.S. small businesses are on the road to recovery from the financial losses experienced ...

May. 12, 2021

A new report by Intuit QuickBooks provides one of the most complete assessments available of the pandemic’s impact on U.S. small business revenue and indicates U.S. small businesses are on the road to recovery from the financial losses experienced during COVID-19.

The report, Intuit QuickBooks Small Business Recovery, uncovers the impact COVID-19 has had across different industries and geographies since March 2020, when the pandemic caused many business owners to temporarily shut their doors. Accounting professionals will want to dig into the report results to provide information to their clients and gauge how their own firms will grow.

Small businesses are recovering

COVID-19 has had a significant impact on the financial health of American small businesses. In fact, small businesses lost $4.6 billion in monthly revenue in April 2020 alone, compared with their pre-COVID-19 revenue, according to the report. However, many have proved to be resilient. As of March 31, 2021, 61

“My clients are currently split in two camps: the ones who have been waiting for things to get back to normal and are hoping to serve their customers in the same exact way it was pre-pandemic, and the ones who proactively adapted and changed their business model, or even reactively forced to adapt to survive,” said Hector Garcia, CPA, who has his own firm in South Florida. “For example, one client who sold high-end specialty fresh mushrooms to restaurants, pivoted and created an entire ‘how to cook with mushrooms’ video course series and sold the cooking kits, including the mushrooms, straight to the customers. He even developed a subscription program to have access to all the new plates and courses every weekend, creating a new kind of customer and completely pivoting their business model.”

Report highlights

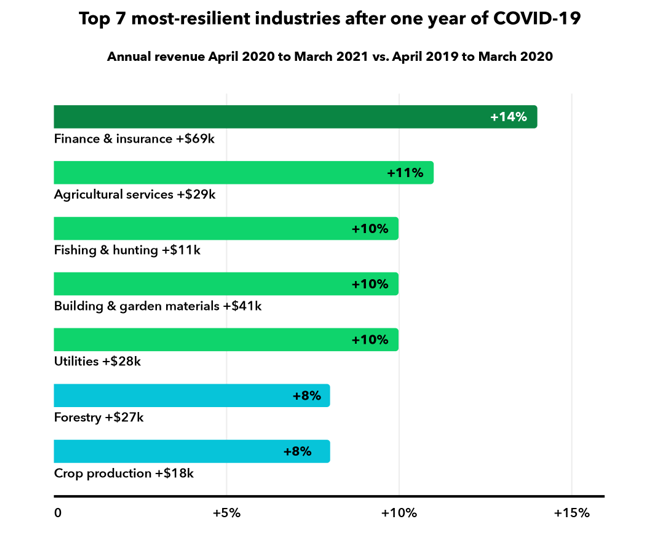

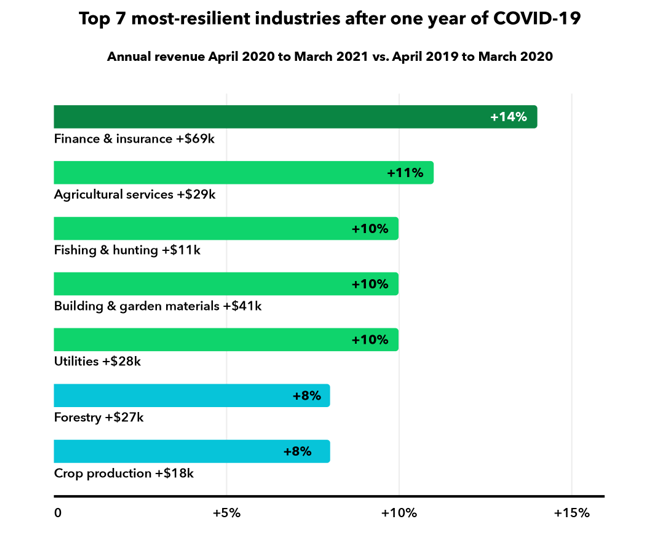

Throughout 2020, the financial health of U.S. small businesses rose and fell in line with the pandemic, as states, counties, cities, and towns responded with varying stringent or lenient COVID-19 operational guidelines. As stricter regulations on how small businesses could operate were put in place, revenues fell; as regulations were lifted, small businesses saw opportunities to rebound. One year later, QuickBooks data reveals that even some of the hardest hit small businesses are experiencing a recovery.

● In general, businesses in high-density urban areas — especially on the east and west coasts — experienced a greater negative financial impact than those in rural areas. Brooklyn, New York, and San Francisco were among the worst-hit cities.

● Some of the biggest losses were in the recreation industry. For example, bowling alleys’ annual revenues are down by 33% — a drop of more than $250,000 per business — compared to before the pandemic.

● Home improvement and real estate businesses have been among the top performers over the past 12 months. At the end of March 2021, mortgage bankers’ annual revenues were up by 30% compared to their pre-pandemic level — an increase of $147,000 per business.

● In regards to accounting and tax services specifically, the report found that Accounting and bookkeeping firms experienced on average a 13% annual revenue increase, which translates into more than $17,900 per business, by the end of March 2021 in comparison to pre-pandemic levels; and Tax return preparation services saw an uptick of 12%, or an average of more than $18,000.

“During this last year, as the pandemic has brought unexpected changes, small businesses have needed Accountants more than ever,” said Ted Callahan, Accountant Business Leader at Intuit QuickBooks. “The community of accountants and bookkeepers have worked tirelessly to solve their clients’ business problems, build their confidence and equip them with the tools they need to take action to protect, sustain, and grow their businesses. This commitment truly inspires our team at QuickBooks to continue to deliver on our vision to help Accountants grow their practices and scale their impact.”

Access the full report and learn more about the sample, data, and methodology.