What might surprise you? A bunch of billionaire investors are doing the same thing. Here’s how you can too.

I officially started Contrarian Thinking in January 2020.

I had some spare time. It has now sprung out 6 different businesses, 2 are trending towards making $1 Million ARR, and 4 are clearing six figures profits.

It is the SINGLE most fun thing I’ve done lately, making money on the interwebs through ideas. Fascinating. Here are my top 5 lessons learned and I’ll be putting together a full playbook on how you can do it too. BUT FIRST – I ain’t alone in this…

Contrarian Take:

Your investment manager will be an influencer.

Before, you had to be a name to get into the hottest funds; now, you have to have a name to grow assets. That’s why:

- Marc “Software is Eating Everything” Andreessen

- Jeff “King of Bonds” Gundlach

- Ray “Principles” Dalio

… spend more time on Twitter than they do wearing PE-approved Patagonia vests.

A new model is emerging… the investor influencer.

And here I thought that finance influencers looked like this:

You know, investment advice, from those without money or experience to those without money or experience. Seems smart.

Truth is – The world of attention arbitrage is moving upstream to z billionaires.

This progression has been whiplash-evoking. When I worked at State Street, I had a tiny little blog called Selling South. Covering investment trends in Latin America as I headed a group down south. When I say tiny, I mean tiny. I mean, not even my mom read it.

Yet, I was told to shut it off because I might (I kid you not) “move the market” with my writing. Which is a fancy way of saying, “It would be better for us if you let the 65-year-old economists do the talking, eh kiddo?”

Also – if I had a dime for every time I got called kiddo in finance, I’d be able to swim in them. Comment below your most ridiculous names called by bosses—always gives me a chuckle.

I recall vividly at Goldman, the tagline our MD coined was “Get Rich Quietly.”

Yet, there is nothing quiet about Carl Icahn sharing insights with 400,000 strangers.

Who’s Carl?

He’s the revolutionary activist investor and corporate raider who took over and asset-stripped TWA and proceeded to become worth $16.7B and the 5th wealthiest HF manager in the world. And it’s not just Carl… we’ve got the head of Andreessen Horowitz himself (net worth $3.5B) sharing things he used to only share in his investor updates.

Thankfully he’s masked as he doesn’t want you to catch something on Twitter. #science

Then we’ve got Cathie Wood, who arguably grew her portfolio and proceeded to pump it to the moon, using the power of Twitter and sharing every single trade she makes. Back in my day, we guarded our trades, now investors are yelling out of megaphones. Oh, how the times have changed.

What is your point, Codie?

My point is that we in finance understand one thing really well.

L-E-V-E-R-A-G-E

Leverage is the multiplier.

If you REALLY like a deal, you don’t just go ALL in. You go 110%+ in.

There are four types of leverage:

Labor + Capital + Code + Audience

They have each ushered in a new age of wealth and abundance for those in charge:

- Labor (fiefdoms, kingdoms, monopolies)

- Capital (opex heavy industries w/ families like Rockefellers, Rothschilds, etc.)

- Code (technology w/ titan like Jobs, Gates, Bezos)

- Audience (my prediction is these are the ones to watch)

“Audience” is the newest tech-enabled lever. It’s no surprise that investors are capitalizing. Each age of leverage brings massive wealth to those who wield it. If you had access to employees early (or servants), you had bigger profits. If you were able to access banking during its advent, you bought railroads or oil fields and controlled all transport. If you had access to a computer early, you unlocked virtual armies.

Today if you have access to attention, you have access to $0’s.

As we move to the age of audience leverage my bet is, you need to do one of two things.

- Grow your audience

- Grow your company’s audience

So we will talk about how to grow media businesses, your audience, your company’s audience, or your investor base. Then we’ll culminate with a segment from Jack Butcher himself on building your audience and a playbook from me.

Lessons as an Investor turned (GASP) Influencer?

These 5 things turned a newsletter I did on the side in 10 hours of work a week, into a 7 figure business with a bunch of businesses shooting off of it.

- Presell

- Raise Your Prices

- Steal Attention

- Nerd out Over Business Models

- Know Your Math

#1 Give Me Your Money First: Do a Founders Offering

Before you spend time on creating any business, test the market. I ALWAYS test the market. And not like most people who say, “Oh, I have this idea I’m going to do, it’s going to be amazing, change the world, next Uber of X, would you use it?”

I don’t care for opinions. I care for your dollars. Give me them.

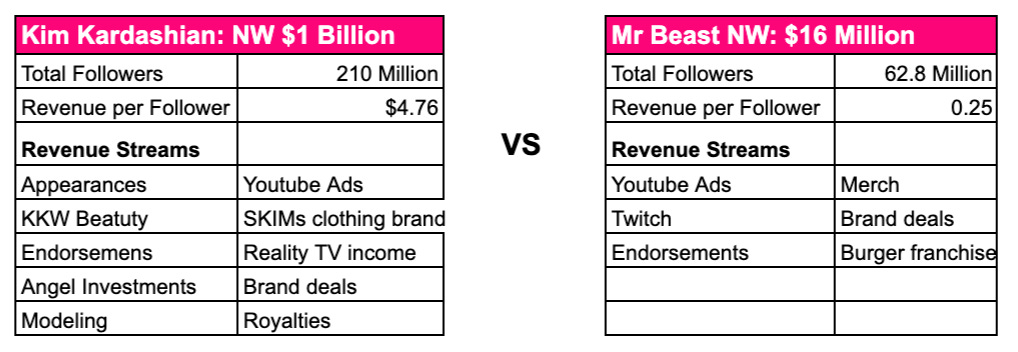

#2 Choose Your Price: Then Add a Zero to It

I ALWAYS underprice. It’s a personal fault. Lesson of the day. Don’t be Codie. For one of my businesses, Unconventional Acquisitions, we stair-stepped the price and kept finding the more we raised, the more we sold, and THE LESS CHARGEBACKS and HEADACHE we had.

So don’t be afraid to price higher. Right now, our premium version of this newsletter costs $299 for a year. I’m going to up it to $500 by the EOY. It’s worth it 10x.

#3 Be A Leech

The single biggest way to grow? Piggyback off someone else’s content. I did this ad nauseum with Trends, The Hustle, Side Hustle Nation, and a slew of other Facebook groups. I gave until my eyes hurt from writing out responses and sharing. Then I gave more. Then I started sharing my articles, and the subscribers started FLOWING.

If I was to do it again. I’d do that. BUT I’d also leech off of Twitter accounts. Twitter is by far the best way for RN to grow email. My new bud Alex – breaks down how to use Twitter like a G.

#4 Get Obsessed with Business Models

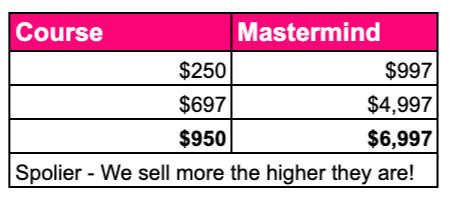

Kim Kardashian has 210 million followers. Mr. Beast has 30% of that. Yet, he certainly doesn’t have 30% of her net worth. He has 1.6%. Why?

Kim and her team understand business models. It’s why she has multiple revenue streams, moated businesses (not just easily duplicated, low margin, and poor quality merch), and investments.

SO – if you’re going to grow wealth, you can’t just have followers; you need to know what to do with them.

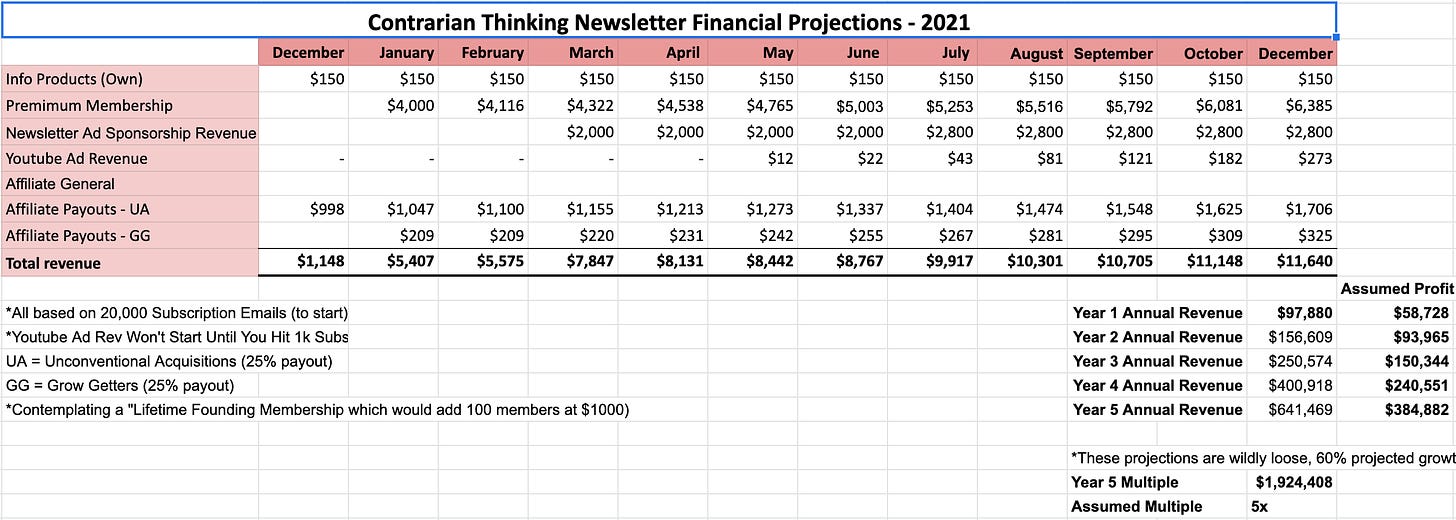

#5 Know Your Numbers

This was my original model. I thought off of 20k subscribers; you could do about $90k in profit in year one.

Instead, we did $150k in revenue in the first quarter.

And we’re growing faster than the national debt. Too soon?

The benefits of looking at THOUSANDS of deals from investing in them. I knew which revenue lines to add and which to ignore. Aka – ignore YT ad revenue, double down on branded online products.

- TLDR

- Get yourself an audience.

- Learn how to monetize it.

- Add investments to the mix.

Then maybe move out of this country because, dear lord, are we printing money faster than we can hand it out.

SIDENOTE: I read a fascinating article, thanks Alex, on what happens when countries default on debt.

Essentially, anytime a country has gone to 130% debt / GDP, it has been a metaphorical point of no return. THE US HIT THAT.

Do you want to hear more about it? Tell me in the comments.

Question everything and find your leverage

Codie