And how to spot the next crumble cookies long before they become famous

Contrarian Rant

My most recent purpose. Become “unfuckwithable,” so strong of mind, body, and balance sheet that when the inevitable power exertions come you can kindly push le f*ck back. The world is increasingly necessitating this attitude. Let me tell ya a little story, my Contrarians.

I was in transit with an airline this week and surprise surprise, the service reminded me of being a middle school kid who had to go to the bathroom.

“Please, please teacher, will you allow me to relieve my bowels and leave your vaulted presence if only for a moment? No? May I speak? No? May you explain to me why x, y, or z? No? Ok, I’ll just sit here in misery.” Odd when you think about it. Rules are great. Power trips and rules that lack all common sense, are not so great. So – I’ve decided I’m done with that. How done?

Well, to be honest, I’m kinda cheap with flying. I always fly coach unless it’s international, I got a thing for Southwest cattle drives, I bring my own snacks. I have that “my parents were immigrants” type of energy. I’ll buy million-dollar businesses but an upgraded ticket for a 2-hour flight for $1,000 meh, probably not.

HOWEVER – I have now decided to leapfrog the whole ‘first-class lay flat or die’, ‘private planes or I’m not going’ idea, and jump right to buying an m-fing fleet. It’s a big hairy ridiculous goal but if you’re building the next airline company that charges more but actually loves its passengers, you have an investor.

Since when did companies deign to serve us? We pay them. They are in the service industry. They and the government need to remember that term. But complaining gets us nowhere. Around here, if we don’t like something we build it better. Then we take their lunch. *Wink*.

So – what are you doing to become “unfuckwithable,” and is your goal so audacious that if you don’t hit it you’ll still be a titan? Mine… toppling dictators and not owning the plane, but taking down the whole damn fleet.

Now, Meet Franchisees Who Turned Others Ideas Into $$$

Most twenty-somethings in my day were all about two things, sneaking out and making bad decisions… did I say most twenty-somethings or did I mean me? Anywho, the subject of this week’s newsletter was clearly built differently. At 24, Erik bought his first franchise and grew it to 40 locations, over the next 10 years, and millions of dollars in profits.

In the next ten, he bought 6 more franchises, sold even more brands as a franchisor, then hit $100M+ in franchise fees as a franchising consultant. He’s obviously an underachiever. Now y’all know I’ve had quite the opinion about franchises (read: not that into them) but when Erik explained a few models to me, I got intrigued.

We spoke with Erik this month and asked him to break down the secrets to cash flowing five to six figures as a franchisee.

Here’s the inside scoop on a man who takes others’ ideas and turns them into dollars…

Today in < 10 minutes → We’re Going to Dive into:

- Exploring the Pros of Franchising

- The Right Way to Buy a Franchise

- The Truth About Royalties

- How can you replicate it?

So What Is Franchising?

Someone else has an idea, people love it, they wrap processes around it so it’s repeatable and branded, and you pay for the right to take their ideas and profit off it.

- In & Out, Massage Envy, Orange Theory, Crumbl, Starbucks, etc, etc, etc.

I do like the idea of de-risking your investment and accelerating your cashflow. As someone who’s started a few businesses, I’ll tell you this. Building a business from the ground up is back-breaking work. You wear all the hats, plus you can almost always expect something to go sideways.

On the flip side, buying a business can be a profit hack. When you buy an existing business, you aren’t just taking over their brick-and-mortar storefront, you’re also buying their systems, suppliers, customers, and dozens of other economic factors that could have taken you exponentially more time and effort to get on your own. It’s why my mantra has often been buy > build.

Franchises are a version of this but… franchising gets a bad rap (from me).

You hear a lot of people (aka me) saying things like…

- ‘But it’s not even YOUR brand.’

- ‘Why help someone else build their company when you can just go out and start your own?’

- ‘You’re basically buying yourself a job.’

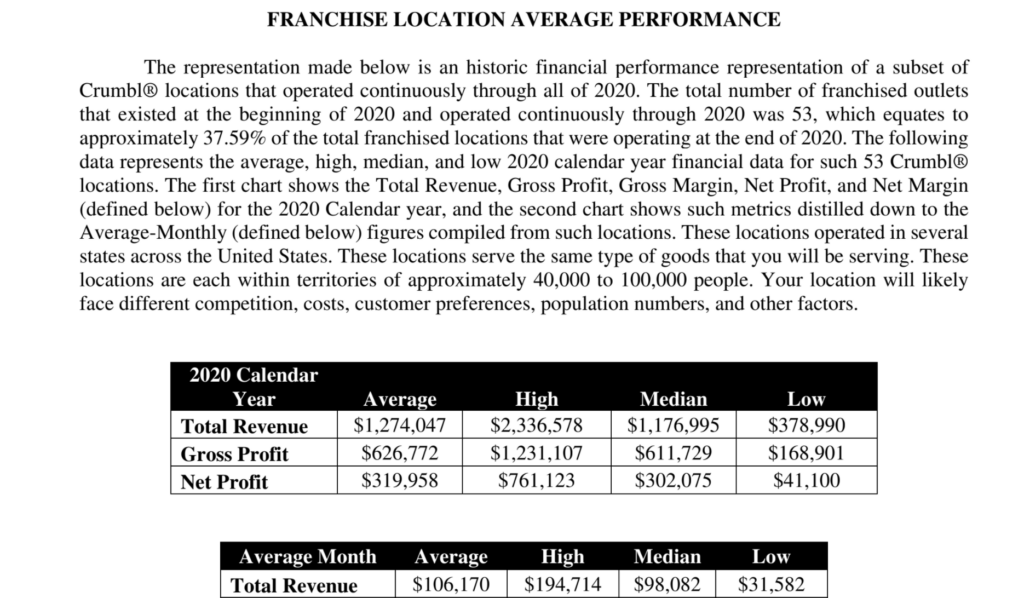

But is that the truth? Let’s look at the numbers because they lie less.

What’s It Going to Make Me?

You’ve heard Erik’s model, how about we break down another Cashflow member… Henry’s.

- He bought a Massage Envy while working.

- It cost him a few 100k, and he hired an operator.

- They broke even within a year, were profitable the following month, and now have businesses that generate $2M+ which allowed him to quit his golden handcuff job.

No guarantees in life but that doesn’t suck. It prompted me to dig in and I may be investing in a franchise this next year. Why? Here’s a breakdown of the average franchise costs and profits. Spoiler alert, it’s not too shabby.

What’s It Going to Cost Me?

In a common scenario, franchise costs are something like this:

- $25k-100k for the franchise fee

- 5-15% royalty or profit share fee

- $60k-$1M for startup costs

- Total Cost: $100k-$1M+

Getting Gritty: Franchise Examples

Another Argument for Franchising? Training.

According to the 2020 Industry Training report, it costs small companies an average of $1,111 every year to train an employee. That doesn’t include the $4000 it costs to orient a new employee. For a non-franchise business with one location and six employees, training costs can easily climb to $30k annually. Make sure the franchise group you are looking to partake in has a training program, you’re paying for it after all.

The Right Way to Buy A Franchise

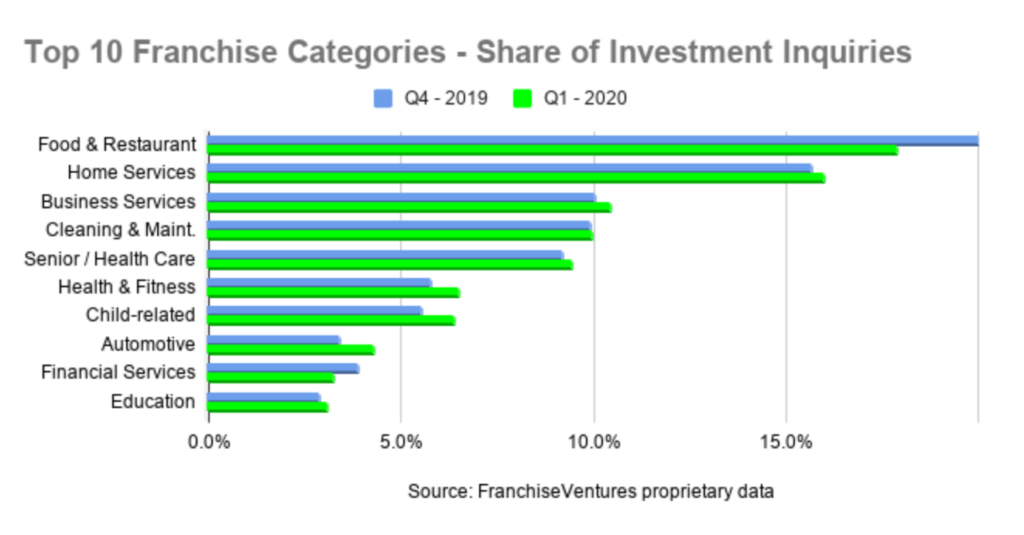

Franchises Are More Than Just Food

When most people hear the word ‘franchise’, their minds immediately zip to McDonald’s, Starbucks, or any of the other multi-billion dollar restaurant franchises.

Fast-food chains are the industry’s best-performing sector but only account for 32.9% of national franchising revenue.

That leaves 67.1% of the franchising $$$ on the table.

How do you get in?

Erik shared his formula for spotting viable franchises, one that’s netted him a lot of zeros over the last 20 years. And it really only boils down to one thing.

Target Emerging Brands

‘Why not established brands, Codie?’

The answer’s quite simple. Emerging brands are typically more entrepreneurial-minded. A brand with 20 or fewer locations will be more motivated to grow than one that’s already opened 100+ stores.

Plus, franchisors tend to go above and beyond for their early franchisees. Whether it’s with systems, support, or training…Day 1 franchisees usually get the whole nine yards. This is because if brands’ early locations don’t succeed, there can be no expansion.

It’s also important to remember that it’s next to impossible to buy into a franchise that already has brand recognition. Big-name franchisors like Orangetheory are buying out their franchisees in a bid to keep their circle small. A good rule of thumb is if the brand’s already popular enough to pull 350k+ followers on Instagram, there’s a good chance you can’t get in.

Study The Founders

That said, you also want to examine the franchise’s founders. For Erik, a franchise is only as good as its founders. You’ll want to keep an eye out for someone among the executives that’s recorded some level of success in the industry.

Talk to Other Franchisees

When you’re in the talking stages, franchisors usually give you the contact details of their franchisees.

Call them all.

Don’t settle for the top-performing franchisees alone. They’ll mostly have good things to say. Instead, reach out to every franchisee you can find. When you do, don’t just ask fluffy questions. Cut to the chase. Run numbers with them. Find their pain points. If there’s overall profitability among franchisees, there’s a good chance you’ll be profitable too. If not, then that’s a red flag.

Alternatively, if you’re pressed for time:

Download the FREE list of Top Questions to Ask Any Franchisee (so you don’t miss a thing)

What about Royalty Fees?

When it comes to royalties, franchisors can go either of two ways. Flat or percentage-based fees. Which begs this question…which is better?

When asked about flat royalty fees, Erik’s response was painfully honest.

Flat royalty fees don’t incentivize franchisors to help their franchisees succeed. Whether you win or lose, they get their paycheck at the end of the fiscal year. On the other hand, with percentage-based royalties, the brand’s performance is closely connected to yours. And that usually motivates them to give you all the tools you need to cashflow quickly.

That said, royalty fees will vary from brand to brand. The Twitter-famous, anonymous ‘Wolf’, pointed out the standard range spans from 6 – 8% of franchisee revenue.

It’s also not uncommon to find national brands whose business models require you to pay a 6% royalty, 3% to a national brand fund that will be used for all franchisees, and 3% in miscellaneous fees.

Regardless, you will find franchisors that charge as much as 10 – 15% in royalties.

Let’s Break It Down

So you think this sounds like your calling? Cool. What do you do?

1 – Research. A no-brainer right? Research is key to figuring out what franchises are expanding in your area and what industries do well, combined with your skillset or interest.

2 – Review the FDD. The franchise disclosure document (or FDD) differs for every franchise. This document breaks down the financials of the business as well as gives you a demographic look into other franchises of this brand that are doing well.

3 – Figure out your financing. Financing franchises can be a bit of a catch-22. See, banks have a hard time backing first-time franchisees for established range brands because they don’t know your level of experience. On the other hand, banks have a hard time backing emerging brands because there’s little data to back their performance. More time than not you’ll have to foot the bill here or get OPM.

Franchising is Not For Everybody

When it comes to franchising, initial costs tend to be on the high side. It’s not uncommon to see franchisees spend up to 3x what they would if they were starting their business. There are also operational costs that can quickly snowball into a lot of zeros depending on the industry.

Strict regulations are another downside to the franchising industry. Whether it’s with big-picture stuff like locations or creative decisions like marketing, franchisees aren’t allowed to call the shots. If coloring inside the lines and playing by someone else’s rules doesn’t sound like you, then skip.

And of course, there’s also the risk of failure. Statistically, franchisees close up shop as often as indie business owners. Plus, there’s always the chance of your franchisor going belly up.

I may play in this space but y’all have permission to publicly flog me if I start investing in fast food franchises, the last thing we need more of in the world, eh?

Question everything and steal another’s playbook,

Codie